Infographics

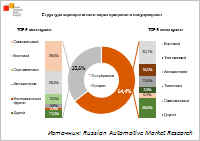

Corporate trailer and semi-trailer population

According to Russian Automotive Market Research, as of January 1, 2020 the corporate trailer and semi-trailer population in Russia numbers 492.7 thousand units.

Semi-trailers account for 64.4% of the corporate vehicle population. It is dominated by dropside vehicles.

Trailers account for 35.6% of the corporate vehicle population. Dump trailers are in the greatest...

More ...

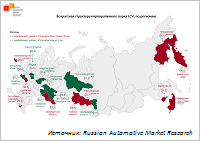

Age structure of the corporate fleet of LCV, by regions

According to Russian Automotive Market Research, as of January 1, 2020 the corporate LCV population in Russia numbers 1.09 million units.

Vehicles older than 20 years account for 12% of the corporate vehicle population. Primorsky region is the leader among regions with the oldest LCV population – 36.8% of the region's corporate vehicle population. There is a large number of «old» LCV in the Kamchatka and Orel regions – 36.5% and 34.5%, respectively.

LCV aged 3 years and under account for...

More ...

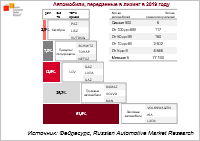

Vehicles leased in 2019

According to Russian Automotive Market Research, in 2019* 229.2 thousand vehicles and trailers were transferred to financial leasing. Cars accounted for 51.5%, trucks - 25.3%, LCV - 12.5%, trailers and buses - 7.8% and 2.9%, respectively.

Demand for leased vehicles is unevenly distributed. In 2019 91.3% of lessees leased less than 5 vehicles. The share of lessees with lease contracts for 500 vehicles and more was 0.01% or 6 lessees.

________________. * Hereinafter financial leasing contracts...

More ...

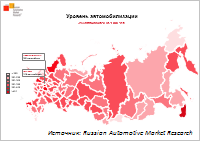

The level of motorization in Russia

According to Russian Automotive Market Research, as of January 1, 2020 the car population in Russia numbers 45.15 million units.

There are 313 cars per 1 000 residents of Russia on average. The level of motorization in 35 regions of the Russian Federation is higher than the national average one. The highest availability of cars is in the Primorsky region - 463 cars per 1 thousand inhabitants.

The Chukotka AR has the least number of cars per 1 thousand population (86 units). The list of...

More ...

Forecast of truck and LCV residual value, TOP-3 reefers

Russian Automotive Market Research prepared forecasts of the residual value of light commercial vehicles and trucks for 5 years.

The reports predict depreciation of the best-selling LCV models and trucks for 1 year, 2 years, etc. up to 5 years of operation. Each model under consideration has a specified body type (van, reefer, etc.).

According to RAMR's forecast, GAZ 3302 will be the leader among TOP-3 reefers in the LCV market after 5 years of operation by residual value preservation with a...

More ...

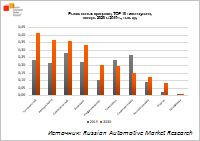

New trailer sales, ТОР-10 body types, January 2020/2019, thousand units

In January 2020 the market of new trailers and semi-trailers[1] showed positive dynamics (+29.5% on January 2019) and amounted to 2.28 thousand units.

In January 2020 SCHMITZ became the market leader and sold 0.29 thousand trailers, which was a 163.6% rise year-on-year. TOP-3 also included TONAR and KRONE.

Almost all TOP-10 brands showed sales growth except WIELTON and KAESSBOHRER. Demand for WIELTON trailers remained at the level of January 2019, while that for KAESSBOHRER vehicles fell by...

More ...

Other research

Market analysis