06.12.2023 / New truck sales forecast for 2024

According to the baseline forecast scenario, in 2024, new truck sales will amount to 140.27 thousand units. Under the optimistic scenario, sales will reach 144.30 thousand units, while under the pessimistic scenario, they will reach 134.88 thousand units.

The baseline forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- In 2024, KAMAZ vehicle sales in the Russian market will increase by 6.67% on 2023. Other Russian and Belarusian brands will also increase sales, but their growth rates will be lower than those of KAMAZ.

- In 2024, sales of Chinese brands in the Russian market will grow slightly (by 4.45%) on 2023. They will be negatively affected by the increased recycling tax for trucks.

- Part of the demand for trucks has already been met in 2023, but in 2024, the need in new trucks will remain due to increase in freight transportation distances, the need to provide vehicles to new regions, and changes in vehicle replacement cycles (with the increase in transportation distances, vehicles will wear faster).

- BIG-7 brands will not return to the Russian market in 2024.

- The import of trucks under parallel import will be carried out in a small volume.

- State support measures for the truck market will be implemented in 2024. The volume of their financing in 2024 will increase on 2023.

- Starting Q II 2024, the key rate will likely decrease. This will result in the increase in new vehicle sales on credit and lease.

- Sanctions against Russian carriers by EU countries will remain. The volume of international traffic in 2024 will be at a level slightly higher than in 2023, and Russia's trade turnover with Asian countries will continue to grow.

- The macroeconomic situation in Russia will remain unstable. In 2024, GDP may grow by 1.4% on 2023, inflation will be 6.2%. Retail trade turnover may grow by 1.7% in 2024, while freight turnover of motor vehicles may grow by 5.6%.

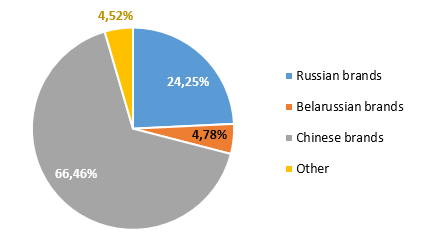

According to the baseline forecast scenario, mainly Russian, Chinese and Belarusian brands will continue to be sold in the Russian truck market in 2024. New vehicles imported under parallel imports and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will also be sold.

Under the baseline scenario, 140.27 thousand new trucks may be sold in 2024.

The optimistic forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- In 2024, KAMAZ vehicle sales in the Russian market will increase by 10.63% on 2023. Other Russian and Belarusian brands will also increase sales, but their growth rates will be lower than those of KAMAZ (sales of these trucks will be higher than under the baseline scenario).

- In 2024, sales of Chinese brands in the Russian market will grow slightly (by 5.56%) on 2023 (sales will be higher than under the baseline scenario). They will be negatively affected by the increased recycling tax for trucks.

- Part of the demand for trucks has already been met in 2023, but in 2024, the need in new trucks will remain due to increase in freight transportation distances, the need to provide vehicles to new regions, and changes in vehicle replacement cycles (with the increase in transportation distances, vehicles will wear faster).

- BIG-7 brands will not return to the Russian market in 2024.

- The import of trucks under parallel import will be carried out in a small volume (but higher than under the baseline scenario).

- State support measures for the truck market will be fully implemented in 2024. The volume of their financing in 2024 will increase on

- Starting Q II 2024, the key rate will likely decrease. This will result in the increase in new vehicle sales on credit and lease.

- Sanctions against Russian carriers by EU countries will remain. The volume of international traffic in 2024 will be at a level higher than in 2023, and Russia's trade turnover with Asian countries will continue to grow.

- The macroeconomic situation in Russia will remain unstable. In 2024, GDP may grow by 1.7% on 2023, inflation will be 5.1%. Retail trade turnover may grow by 2.1% in 2024, while freight turnover of motor vehicles may grow by 6.2%.

According to the baseline forecast scenario, mainly Russian, Chinese and Belarusian brands will continue to be sold in the Russian truck market in 2024. New vehicles imported under parallel imports and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will also be sold.

Under the optimistic scenario, 144.30 thousand new trucks may be sold in 2024.

The pessimistic forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- In 2024, KAMAZ vehicle sales in the Russian market will increase by 5.4% on 2023. Other Russian and Belarusian brands will also increase sales, but their growth rates will be lower than those of KAMAZ (sales of these trucks will be lower than under the baseline scenario).

- In 2024, sales of Chinese brands in the Russian market will grow slightly (by 0.54%) on 2023 (sales will be lower than under the baseline scenario). They will be negatively affected by the increased recycling tax for trucks.

- Part of the demand for trucks has already been met in 2023, but in 2024, the need in new trucks will remain due to increase in freight transportation distances, the need to provide vehicles to new regions, and changes in vehicle replacement cycles (with the increase in transportation distances, vehicles will wear faster).

- BIG-7 brands will not return to the Russian market in 2024.

- The import of trucks under parallel import will be carried out in a small volume.

- State support measures for the truck market will be partially implemented in 2024.

- Starting Q II 2024, the key rate will likely decrease. This will result in the increase in new vehicle sales on credit and lease.

- Sanctions against Russian carriers by EU countries will remain. The volume of international traffic in 2024 will be at a level slightly higher than in 2023, and Russia's trade turnover with Asian countries will continue to grow.

- The macroeconomic situation in Russia will remain unstable. In 2024, GDP may grow by 1.1% on 2023, inflation will be 8.3%. Retail trade turnover may grow by 1.1% in 2024, while freight turnover of motor vehicles may grow by 3.4%.

According to the baseline forecast scenario, mainly Russian, Chinese and Belarusian brands will continue to be sold in the Russian truck market in 2024. New vehicles imported under parallel imports and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will also be sold.

Under the pessimistic scenario, 134.88 thousand new trucks may be sold in 2024.

New truck market composition forecast in 2024, baseline scenario

Source: NAPI (National Industrial Information Agency)