24.05.2022 / Car market forecast

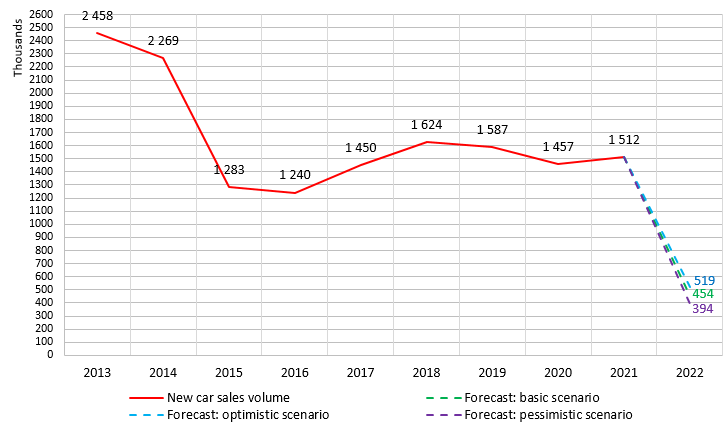

New car market forecast is formed taking into account three scripts: basic, optimistic and pessimistic.

According to all forecast scripts, Russian automotive market has been negatively affected by following factors

- Sanctions.After 24th February 2022 there were economic sanctions imposed against Russian Federation. They affected among other the automotive market. For example, countries which imposed sanctions prohibited the import of microelectronic devices and auto components into Russia. Russian plants, such as AvtoVAZ on manufacturing platforms in Izhevsk and Togliatti, Renault in Moscow, Hyundai and Kia in St. Petersburg, Nissan in Moscow, Toyota in St. Petersburg, «Autotor» in Kaliningrad, «Mazda Sollers» in Vladivostok, «PSMA RUS» in Kaluga region, Volkswagen Group Rus on manufacturing platforms in Kaluga and Nizhny Novgorod, UAZ and several other manufacturers had to suspend their work since February-March because of delays in auto components` supplies. Since June, 6 2022 AvtoVAZ plans to put a 4-day working week.

Besides that, many other foreign automotive brands (Nissan, Toyota, Mitsubishi Volkswagen, Mazda, Skoda, BMW, Mercedes-benz, Audi, Jaguar, Land Rover, Lexus etc.) temporarily stopped supplies of imported vehicles into Russia.

In the middle of March, EU and USA imposed an embargo on luxury product supplies into Russia, including expensive cars. In the beginning of April, a similar embargo was imposed in Japan.

- COVID-19 lockdowns in China. The restrictions referred to the COVID-19 pandemic in China in 2022 can lead to delays in auto components` supplies for the Russian manufacturing platform of Haval and other Russian OEMs using Chinese components. The import of Chinese vehicles into Russia will be inevitably reduced. All these factors will provoke new manufacturing outages and growth of vehicle shortage on the Russian market.

- Decline of Russian macroeconomics. Sanction put a negative effect on macroeconomic figures. According to the Central Bank forecasts, Russian GDP can be reduced by 8-10% in 2022.

Inflation level in Russia showed 17,8% in April 2022, according to Federal State Statistics Service. In the end of 2022 Russian Ministry of Economic Development predicts 17,5% inflation. Inflation growth leads to decline of population real income and decrease of composite demand. A part of customers will postpone expensive purchases (including vehicles).

Autocredits appreciation can also negatively affect the automotive market because of Russian Bank key rate increase in comparison with 2021. Since 29th April 2022 the key rate measures 14%. According to the National Bureau of Credit Histories (NBCH), in April 2022 there were 20,8 thousands autocredits given, what is by 80,7% less than in April 2021. At the same time the automotive leasing also appreciated, what reduced vehicle procurements by corporate customers.

- New vehicles price growth. In connection with logistic chains` complication and spare components` shortage for vehicle manufacturing, new car prices are significantly growing. Considering the decline of population real income, this will lead to further demand reduction on the new automotive market.

- Stopping of state programs. On the 23rd March 2022, the head of Russian Ministry of Industry and Trade Denis Manturov declared that the Russian government does not plan to restart the state programs of beneficial autocredits and leasing. Taking into account that last years the mentioned programs provided a significant support of the automotive market, their expend is an additional factor provoking new car sales decrease.

- TCO growth. In 2022 г. prices for spare parts, tires etc. showed a significant increase. TCO growth can negatively affect the decision making about new car purchases in 2022.

- Big variety on the used vehicle market. Last years, a diversified used vehicle fleet was formed in Russia. During the crisis a part of customers prefers used vehicle purchases to the new ones, including «grayly» imported vehicles. However, the supply of used vehicles on the market can gradually decrease, because the ex-owner of a used vehicle can face several difficulties while buying a new one.

Despite that, here are given the factors allowing to minimize negative tendencies on the new car market in 2022.

- Parallel import legalization. On the 6th May 2022, Russian Ministry of Industry and Trade published the list of vehicles and spare parts available for parallel import without right owner`s authorization. The allowed brand list included Land Rover, Jaguar, Bentley, Hummer, Tesla, Mercedes-Benz, Maybach, Lexus, Infiniti, Lamborghini, Ferrari, Aston Martin, Porsche, Rolls-Royce, Maserati, Bugatti, Toyota, Volkswagen, Skoda, BMW, Renault, Audi, MINI and Nissan. The parallel import provides foreign vehicles inflow on the Russian market, however, in connection with logistical complications, supply volumes do not tend to be significant in the current year and will not lead to significant market growth.

- Russian, South-Korean and Chinese brands conservation on the market. South-Korean and Chinese brands plan to continue vehicle manufacturing and supplies in Russia. Despite logistical problems while transporting vehicles and spare components, these companies intend to stay on the Russian market and to carry out sales. AvtoVAZ is going to continue manufacturing of the popular Renault Duster under the LADA label and to conserve manufacturing of its own model range in basic modifications. UAZ continues launching of Patriot and Hunter in standard versions.

Basic forecast script supposes that sanction measures against Russia will be conserved up to the end of 2022. AvtoVAZ continues vehicle manufacturing in standard versions and initiates Renault Duster manufacturing under the LADA label in the 4th quarter of 2022 in small volumes (up to 800 vehicles monthly). South-Korean and Chinese brands will be able to establish the logistic chains for vehicle and spare components transport in the 2nd half of 2022 and will conserve sales volume on the April level or insignificantly lower. Vehicles, whose supplies into Russia are prohibited, will be parallel imported in small volumes. Russian economy will show a depressed tendency up to the end of 2022, but without dramatic declines.

Optimistic forecast script supposes that sanction measures against Russia will be conserved up to the end of 2022, but will be gradually relented. AvtoVAZ increases vehicle manufacturing in standard versions and initiates Renault Duster manufacturing under the LADA label in the 4th quarter of 2022 in significant volumes (>800 vehicles monthly). South-Korean and Chinese brands will be able to establish the logistic chains for vehicle and spare components transport in the 2nd half of 2022 and will slightly increase manufacturing and sales level in Russia in comparison with April, although, will not reach January-February figures. Vehicles, whose supplies into Russia are prohibited, will be parallel imported in small volumes. Russian economy will show a depressed tendency up to the end of 2022, but several macroeconomic figures are going to grow in the second half of the year in comparison with March-April.

Pessimistic forecast script supposes that sanction measures against Russia will be conserved up to the end of 2022 and restricted. AvtoVAZ decreases vehicle manufacturing including standard versions and Renault Duster manufacturing under the LADA label will not be initiated in the 4th quarter of 2022. South-Korean and Chinese brands will face logistical difficulties while vehicle and spare components transport in the 2nd half of 2022 and will significantly decrease manufacturing and sales level in Russia. Vehicles, whose supplies into Russia are prohibited, will be parallel imported in insignificant volumes. Russian economy will show a depressed tendency up to the end of 2022, several macroeconomic figures are going to decline in the second half of the year in comparison with March-April.

According to the basic forecast script, new car sales will be reduced by 66,95% in 2022 in comparison with 2021 and will show 454,1 thousand vehicles. According to the optimistic forecast script, the sales will decrease by 65,69%, According to the pessimistic forecast script – by 73,92%.

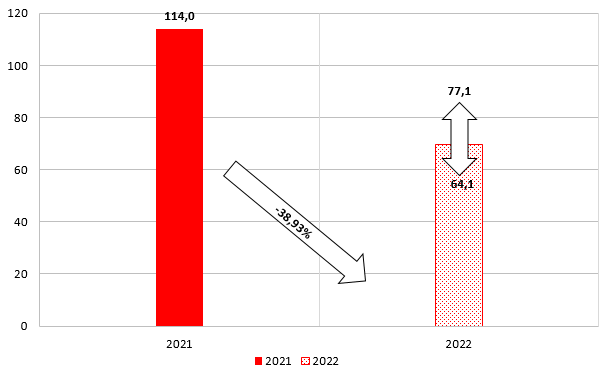

New automotive market forecast up to 2022, thousands

Source: NAPI/Russian Automotive Market Research

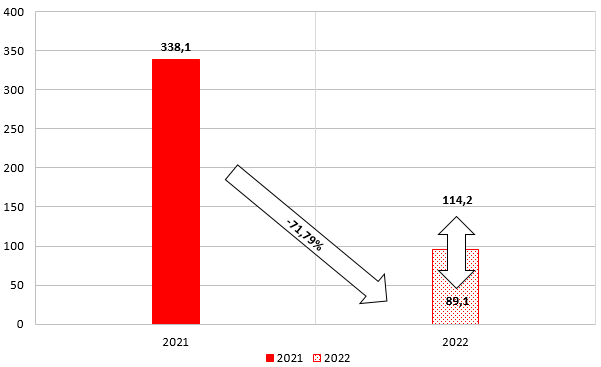

LADA sales forecast (excluding LCV) in 2022, thousands

Source: NAPI/Russian Automotive Market Research

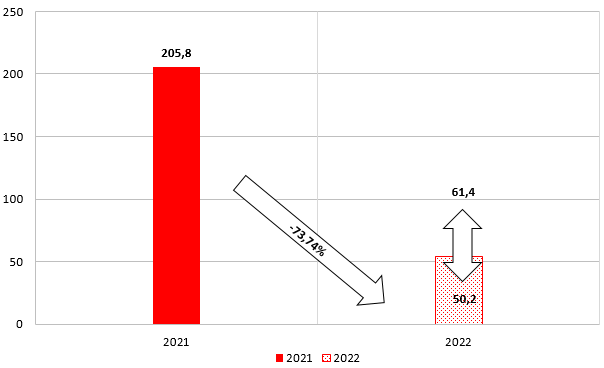

KIA sales forecast in 2022, thousands

Source: NAPI/Russian Automotive Market Research

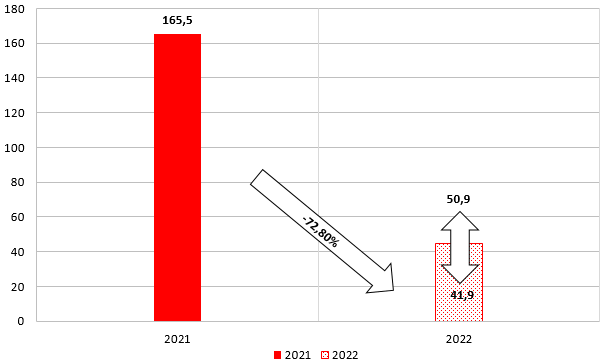

HYUNDAI sales forecast in 2022, thousands

Source: NAPI/Russian Automotive Market Research

Chinese brands[1] sales forecast in 2022, thousands

Source: NAPI/Russian Automotive Market Research

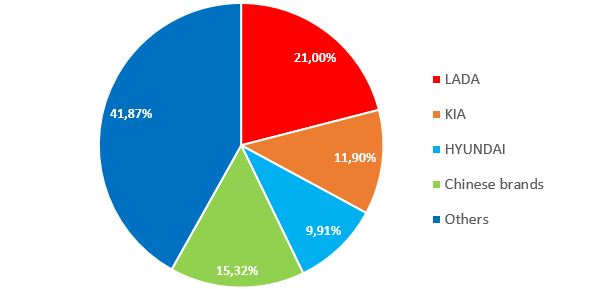

Forecast of new car market structure in 2022

Source: NAPI/Russian Automotive Market Research

__________________

[1] HAVAL, CHERY, GEELY, etc.