29.08.2025 / What has changed in the electric and hybrid car market?

The marketing agency NAPI analyzed the market of new and used electric and plug-in hybrid cars for the period from January 2024 to July 2025.

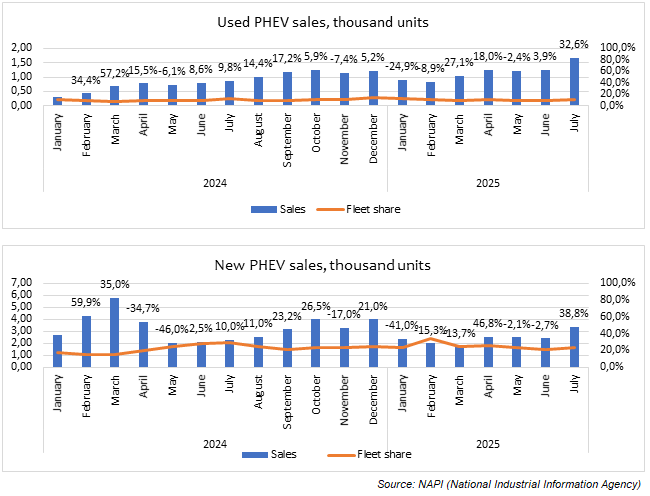

Thus, over the first seven months of 2025, 16.9 thousand new hybrid cars were sold, which was a 26.6% decline on the similar period of 2024. Sales of used hybrid cars, on the contrary, increased by 77% and reached 8.2 thousand units. In July, sales of new hybrid cars grew by 38.8% on June, those of used ones - by 32.6%. In January 2024 - July 2025, the share of corporate clients in total used hybrid car sales fluctuated from 8.15% to 11.9%, new ones - from 14.7% to 33.8%.

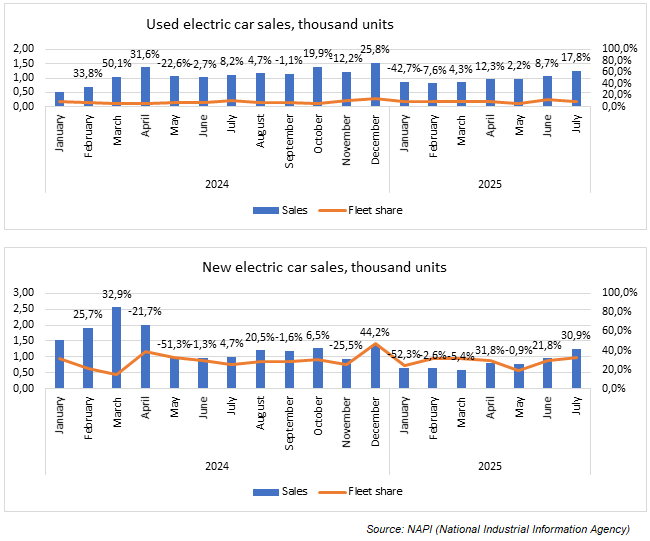

Also, 5.7 thousand new electric cars were sold over the first seven months of 2025, which was a 48.2% decline on the last year. Used electric car sales fell by only 1.2% to 6.7 thousand units. In July, new electric car sales grew by 30.9% on the previous month, those of used ones - by 17.8%. In January 2024 - July 2025, the share of corporate clients in total used electric car sales varied from 5.3% to 12.2%, new ones - from 15.1% to 47.6%.

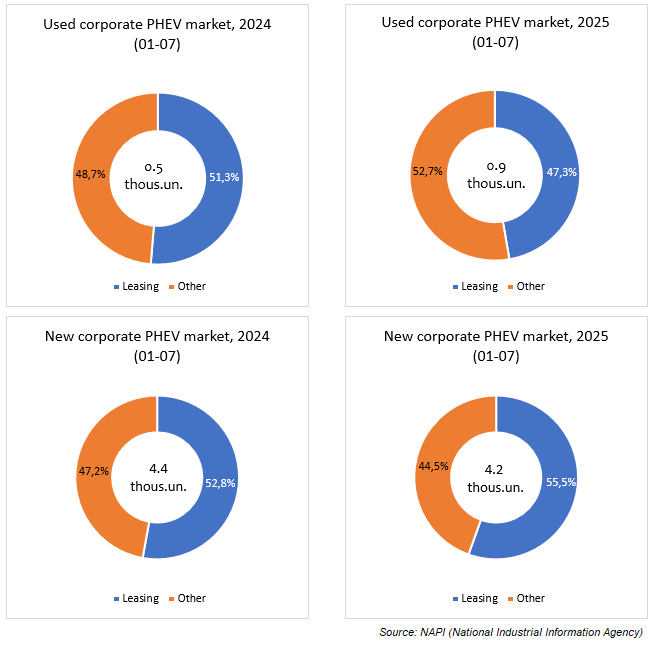

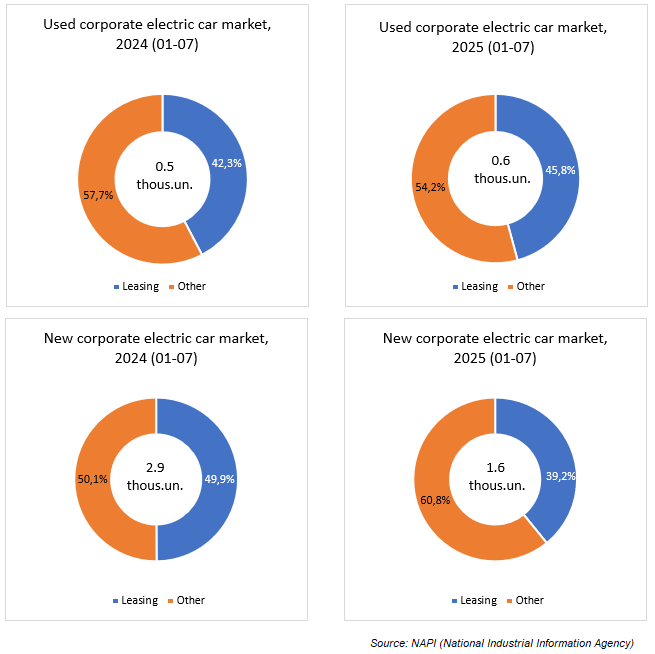

In the new corporate hybrid car market, the share of cars leased amounted to 55.5% in January-July 2025, which was a 2.7% rise on 2024. In the used corporate hybrid car market, the share of cars leased fell by 4% to 47.3% over the year. In the new corporate electric car market, the share of cars leased decreased by 10.7% to 39.2% over the year, while in the used corporate electric car market, it increased by 3.5% to 45.8%.

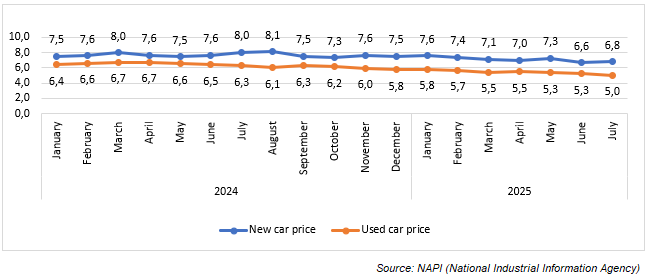

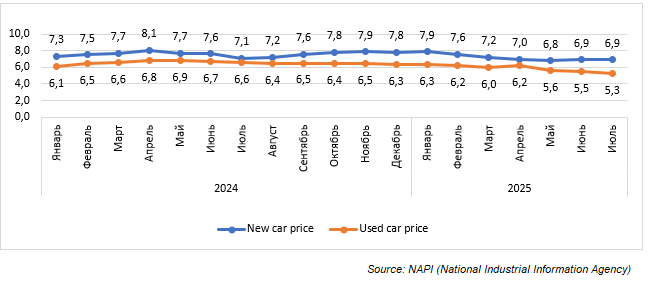

ZEEKR 001 became the most in-demand electric car in 2025, and LIXIANG L7 was one of the most popular hybrid cars. Therefore, these models were selected for analysis of price dynamics. For the period from January 2024 to July 2025, prices for new cars of these models decreased by 0.7 million and 0.4 million rubles, respectively. There was also a decrease in the cost of used cars manufactured in 2023. The price for ZEEKR 001 fell by 1.4 million rubles, and that for LIXIANG L7 - by 0.8 million rubles. However, the price reduction was also due to the fact that by the current year these cars have already become two years old, and their price has correspondingly become lower.

It should be noted that for the period from January 2024 to July 2025, Moscow's share in the total number of hybrid cars purchased in Russia was 34.3%, while the Moscow region's share was 8.9%. Similarly, Moscow's share in electric car sales was 39.3%, while the Moscow region's share was 8.9%. At the same time, some of the benefits introduced in the capital for electric car owners have been cancelled. Thus, previously, there were free charging stations along with the paid ones. Now, all stations have become paid, which erases the advantage of electric cars over those equipped with internal combustion engines in the form of fuel savings.

However, both for the capital and for other regions, programs of preferential lending and leasing of electric cars, as well as regional measures, including preferential taxation, benefits for parking payments, continue to operate. Moreover, until the end of the year, electric cars have the right to free travel on toll federal highways.

New and used PHEV sales, thousand unit

New and used electric car sales, thousand unit

New and used corporate PHEV market, 2024(01-07), 2025(01-07)

New and used corporate electric car market, 2024(01-07), 2025(01-07)

ZEEKR 001 electric car price dynamics,million rubles

LIXIANG L7 hibrid price dynamics,million rubles