07.07.2020 / Vehicle production forecast for 2020-2021

Download The vehicle production forecast is based on three scenarios (baseline, optimistic and pessimistic) and updated taking into account production results in May 2020.

The vehicle production forecast is based on three scenarios (baseline, optimistic and pessimistic) and updated taking into account production results in May 2020.

When updating the forecast the resumption of production of all vehicle and component types in Russia and abroad, state measures aimed to support the automotive market in 2020-2021 were taken into account. Manufacturers gradually resumed their operation, but some of them work with restrictions: one shift, four-day workweek, etc.

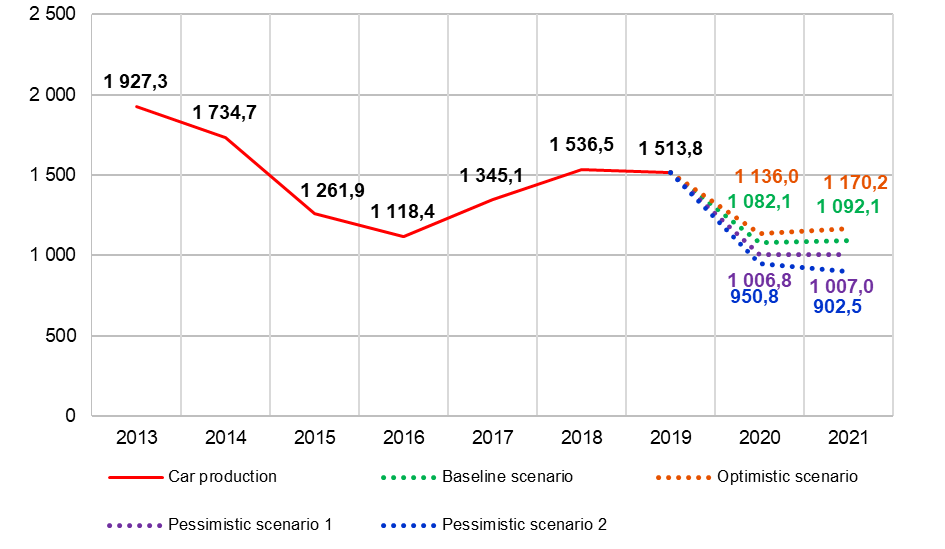

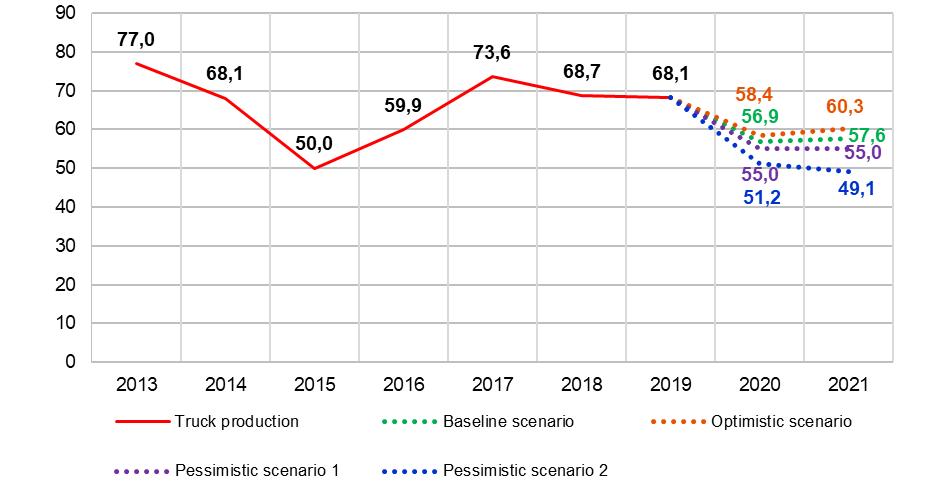

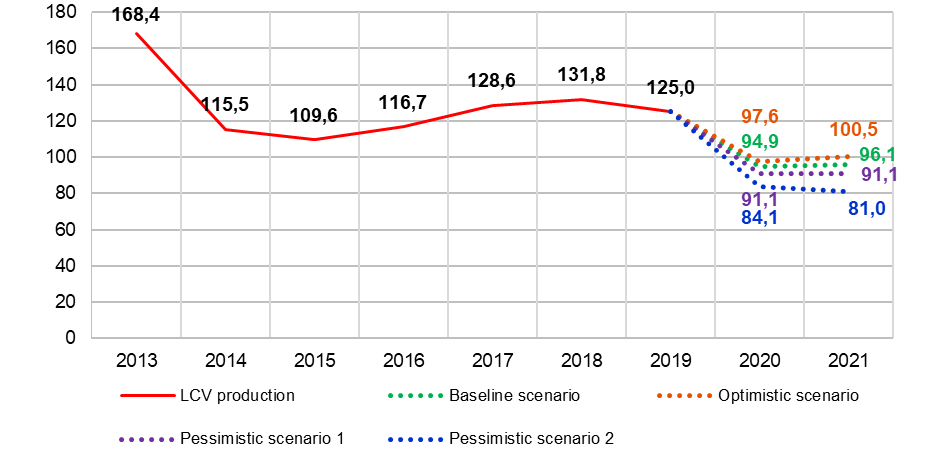

Two pessimistic scenarios were created for each vehicle type included in the production forecast for 2020-2021.

Pessimistic scenario No. 1 assumes that the main negative impact of the current epidemiological and economic situation will occur in 2020, while in 2021 the economy is expected to gradually recover due to rising oil prices, strengthening of the national currency and revival of the business activity.

Pessimistic scenario No. 2 implies the possible second wave of COVID-19 epidemic expected in autumn of 2020 - winter of 2021, which will entail the re-introduction of restrictive measures and reduce the rate of economic recovery.

In addition, when calculating both variants of pessimistic forecast scenario it was taken into account that in 2020 advanced public procurement may result in the decrease of demand for vehicles in 2021-2022: the market recovery in the commercial sector will be slow and insufficient for positive sales dynamics, while demand from the public sector will already be met.

C ar production

ar production

In January-May 2020, car production fell by 37.6% on the same period of 2019, in May 2020 the decrease was 57.2%.

Except Mercedes-Benz Manufacturing Rus and Haval Motor Manufacturing Rus, which launched production in May 2019, all car manufacturers reduced their production for the reporting period. The reduction varied from 27.6% (Mazda Sollers Manufacturing Rus) to 54.6% (PSMA Rus). In addition to the far Eastern enterprise, Nissan Manufacturing Rus (including assembly at the Renault Russia plant), UAZ and Toyota Motor subsidiary showed decrease in the production results by less than 30%.

According to the baseline forecast scenario, in 2020 car production will decrease by 28.5% on 2019 and will amount to 1 082.1 thousand units. Under the optimistic scenario, production will fall by 25.0%, while under the pessimistic one - by 33.5%. If restrictive measures caused by the second wave of COVID-19 are re-introduced, the production may be down by 37.2%.

Car production in 2020-2021, thousand units

Source: Russian Automotive Market Research

T ruck production

ruck production

In January-May 2020, truck production fell by 13.9% on the same period of 2019, in May 2020 the decrease was 26.9%.

Against the background of a difficult situation in the new vehicle market, a number of manufacturers increased their production results. In January-May 2020, the production of KAMAZ trucks grew by 7.6% on the same period of 2019. URAL, Iveco-AMT and Avtotor increased their truck production by 5.4%, 12.6% and 19.7%, respectively.

According to the baseline forecast scenario, in 2020 truck production will decrease by 16.5% on 2019 and will amount to 56.9 thousand units. Under the optimistic scenario, production will fall by 14.3%, while under the pessimistic one - by 19.3%. If restrictive measures caused by the second wave of COVID-19 are re-introduced, the production may be down by 24.9%.

Truck production in 2020-2021, thousand units

Source: Russian Automotive Market Research

L CV production

CV production

In January-May 2020, LCV production fell by 30.5% on the same period of 2019, in May 2020 the decrease was 34.1%.

Except Avtotor, which showed positive dynamics of LCV production due to low production results in 2019, all manufacturers of light commercial vehicles reduced their production for the reporting period. Production of such leading manufacturers as GAZ, AVTOVAZ, UAZ and Ford Sollers Elabuga fell by 32.1%, 34.2%, 41.3% and 5.8%, respectively.

According to the baseline forecast scenario, in 2020 LCV production will decrease by 24.1% on 2019 and will amount to 94.9 thousand units. Under the optimistic scenario, production will fall by 21.9%, while under the pessimistic one - by 27.1%. If restrictive measures caused by the second wave of COVID-19 are re-introduced, the production may be down by 32.7%.

LCV production in 2020-2021, thousand units

Source: Russian Automotive Market Research