24.01.2023 / Russian automotive industry: production or import?

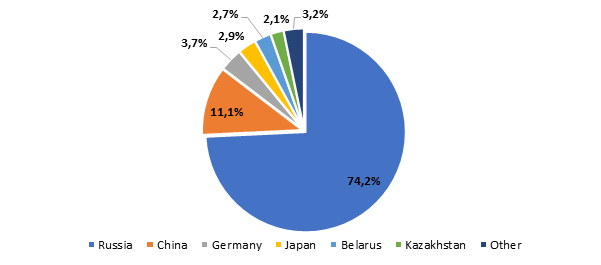

According to the marketing agency NAPI, in 2022, cars manufactured in the Russia accounted for slightly less than three quarters of the new car market. Following results of the last year, the share of such cars decreased by 8.7%.

Predictably, the share of cars manufactured in China, Kazakhstan and Belarus, has increased. If the share of cars manufactured in Belarus grew because their sales did not sink as much as the market as a whole (-22.5% against -53.3%), sales of cars manufactured in Kazakhstan and China were up by 147.4% and 36.1%, respectively, in 2022. A total of 13.7 thousand cars from Kazakhstan and 72.9 thousand cars manufactured in China were sold last year.

New car market by country of manufacture, 2022

Source: NAPI (National Industrial Information Agency)

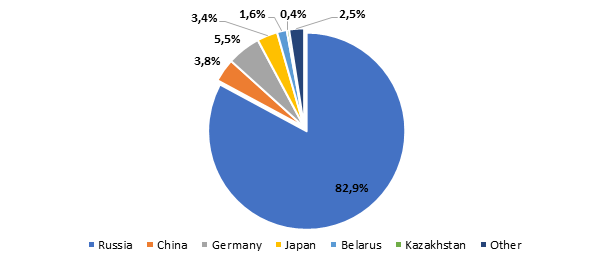

New car market by country of manufacture, 2021

Source: NAPI (National Industrial Information Agency)

HYUNDAI, KIA, CHEVROLET, and JAC cars were mainly imported from Kazakhstan to Russia: these brands accounted for 99.9% of all deliveries of cars manufactured in Kazakhstan. HYUNDAI TUCSON (2.6 thousand units), KIA SPORTAGE (1.8 thousand units), and HYUNDAI SANTA FE (1.1 thousand units) became the best-selling cars last year.

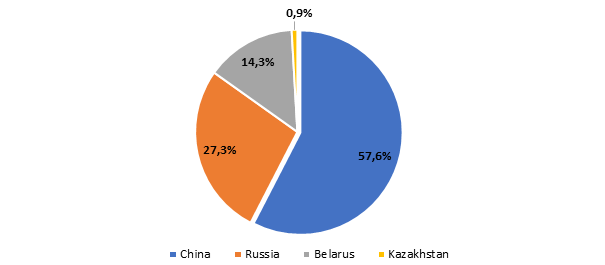

GEELY cars were expectedly imported from the Belarus Republic; 17.4 thousand units were sold in Russia last year. A total of 27.3 thousand GEELY cars were sold in Russia. Thus, most of GEELY cars sold last year were manufactured in Belarus (63.7%), while the cars from China accounted for only 36.3%.

In 2022, China supplied cars of European, American, and Japanese brands manufactured on its territory to Russia, and a total of 2.6 thousand such cars were sold in Russia last year. For example, in September-December, deliveries of Chinese VOLKSWAGEN cars grew at a good pace, although the volume of sales "in units" is still small (0.5 thousand "Chinese" VOLKSWAGEN cars for the entire 2022).

As for HAVAL cars, sales of cars imported from China started in Russia in August. So far, the number of such cars is small – 1.4 thousand units for the entire 2022, but the volume of deliveries grew every month. Following results of 2022, new HAVAL car sales are dominated by cars manufactured in Russia – 96%, but in December, the share of "Russian" cars fell to 81%.

Chinese car sales by country of manufacture, 2022

Source: NAPI (National Industrial Information Agency)

So, while the car production in Russia has decreased, our closest neighbors – Belarus and Kazakhstan - are increasing the volume of deliveries to Russia, including brands that have left the Russian market.

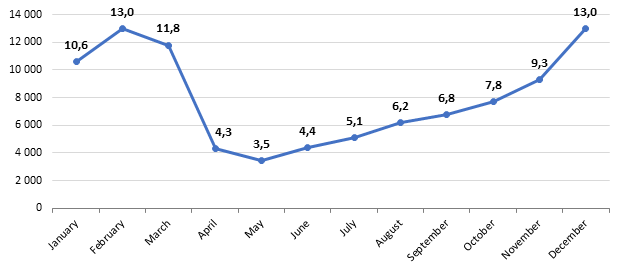

In addition, the cars of European, American, and Japanese brands manufactured in China are imported, and the parallel import of cars manufactured in Germany, Japan, etc. is growing. So, in December last year, 13 thousand cars not manufactured in Russia and in China were sold.

Sales of new cars not manufactured in Russia and in China, 2022, thousand units

Source: NAPI (National Industrial Information Agency)

In our opinion, this situation poses a threat to the production restoration in Russia, including for new projects (Moskvich, Evolute, etc.).

Thus, a wide range of cars that are not available in Russia is manufactured in Kazakhstan; therefore, with the expansion of deliveries of cars from Kazakhstan, some consumers will prefer familiar brands to Russian and Russian-Chinese ones.

Chinese automakers have several options for working in the Russian market:

- increase the import of Chinese brand cars from China;

- increase the import of Chinese brand cars from neighboring countries (Kazakhstan and Belarus);

- increase the production of Chinese brand cars in Russia, while it is only HAVAL;

- expand the production in Russia in cooperation with Russian partners, following the example of Moskvich and Evolute cars;

- expand the deliveries of "non-Chinese" cars manufactured in China.

Various Chinese automakers will most likely combine the above strategies depending on the political and epidemiological situation, saturation of the domestic Chinese market, working conditions in the Russian market (participation in state support programs, state procurement, and other preferences for manufactured cars).

Thus, the coming year will not be easy for the automotive production restoration in Russia.