06.06.2022 / New truck market forecast

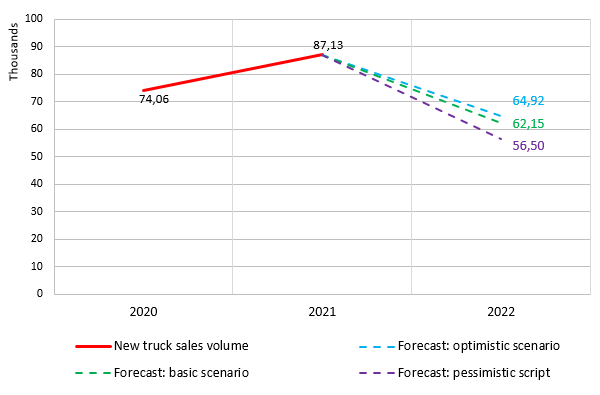

New truck (gross weight >6 tons) market forecast is formed taking into account three scenario: basic, optimistic and pessimistic.

According to all forecast scripts, Russian truck market has been negatively affected by following factors.

1. SANCTIONS

After 24th February 2022 there were economic sanctions imposed against Russian Federation. They affected among other the automotive market. For example, countries which imposed sanctions prohibited the import of microelectronic devices and auto components into Russia.

Stop of auto component supplies from the EU and USA for Russian and Belorussian vehicle manufacturing.

On the 28th of February there was a decision taken about stopping European and American auto components supplies for the PJSC «KAMAZ». The company faced shortage of imported components and is not able to continue manufacturing of trucks and chassis with Cummins engines (USA), ZF transmission (Germany) and Bosch fuel accumulators (Germany).

The GAZ group has been included in the USA Finance Ministry sanction list since the 6th of April 2018. Despite that, before the 25th of May 2022 there was an actual postponement allowing to the Group to work with American suppliers and their affirmed mediators according to current contracts. Since the 25th of May this postponement has been cancelled and GAZ lost access to auto components imported directly from the USA and American companies located in other countries.

Sanctions imposed by the EU and the USA did not affect the plant UralAZ and the Belorussian MAZ in a significant way, because vehicles manufactured by these companies tends to have a high localization level. MAZ has an organized cooperation with Chinese suppliers because of the sanctions against several Belorussian companies in 2020.

Stop of foreign trucks and auto components manufacturing and import.

In February-April Volvo Trucks, Daimler Truck AG, Scania, MAN Truck & Bus, Mitsubishi Fuso, Isuzu and other brands stopped manufacturing on all Russian platforms and stopped new truck and genuine auto components import into Russia. The EU sanctions impose a complete ban of trucks and special purpose vehicle export into Russia (including tractors, medium tonnage trucks, concrete mixers, communal vehicles for street cleaning, dumps, firefighting equipment).

The Russian Hyundai plant temporarily stopped truck manufacturing in March in connection with lack of components caused by periodical logistical problems.

Stop of spare parts supplies and technical service

In February-April European, American and Japanese OEMs stopped spare parts supplies into Russia and suspended the technical assistance and other services necessary for saving trucks in a sustainable consistence.

2. COVID-19 LOCKDOWNS IN CHINA

The restrictions referred to the COVID-19 pandemic in China in 2022 can lead to delays in auto components` supplies for the Russian platforms such as KAMAZ, UralAZ and others using Chinese components. This will inevitably lead to the decline of Chinese vehicle import into Russia. Besides that, there is a possibility of supply delays of components used in engine and transmission manufacturing for MAZ trucks. All these factors will provoke new manufacturing outages and growth of vehicle shortage on the Russian market.

3. DECLINE OF RUSSIAN MACROECONOMICS

Sanctions put a negative effect on macroeconomic figures. According to the Central Bank forecasts, Russian GDP can be reduced by 8-10% in 2022.

Inflation level in Russia showed 17,8% in April 2022, according to Federal State Statistics Service. In the end of 2022 Russian Ministry of Economic Development predicts 17,5% inflation.

In 2022 the international transfer is going to be reduced because of the sanctions. The turnover of bulk trade and retail also tends to decrease, which will provoke financial difficulties for road haulers and companies using trucks for personal needs. In these conditions the truck corporate fleet renewal will be significantly slowed down.

Autocredits appreciation can also negatively affect the automotive market because of Russian Bank key rate increase in comparison with 2021. At the same time the automotive leasing also appreciated, what reduced vehicle procurements by corporate customers.

The autocredit key rate was decreased up to 11% in the end of May 2022 and is going to be decreased up to 10% by the 10th of June 2022. This will lead to decline of credit and leasing rated in June 2022, however, they will exceed the figures of 2021 (key rate 4,25 - 8,5%).

4. NEW VEHICLE PRICE GROWTH

In connection with logistic chains` complication, auto components` shortage for truck manufacturing and increasing inflation, new truck prices are significantly growing. Considering the financial problems of haulers and other companies consuming trucks, this will lead to further truck demand reduction.

5. STOPPING OF STATE PROGRAMS

On the 23rd March 2022, the head of Russian Ministry of Industry and Trade Denis Manturov declared that the Russian government does not plan to restart the state programs of beneficial autocredits and leasing included in the Russian Government statement № 649.

The beneficial program of special purpose vehicle leasing (including vehicles on the truck tires) has been actually functioning according to the Russian Government statement № 811. However, according to SberLeasing, its budget had been reduced from 2 billion to 500 million rubles, that was already expired. New assignments of this program are not put in federal budget.

The procurement volumes of gas engine trucks in 2022 are not determined.

Taking into account that last years the mentioned programs provided a significant support of the automotive market, their expend is an additional factor provoking new truck sales decrease.

6. TCO GROWTH

In 2022 г. prices for spare parts, tires etc. showed a significant increase. TCO growth can negatively affect the decision making about new truck purchases in 2022.

7. BIG VARIETY ON THE USED TRUCK MARKET

Last years, a diversified used truck fleet was formed in Russia. During the crisis a part of customers prefers used vehicle purchases to the new ones, including «grayly» imported vehicles. Besides that, «fresh» used trucks can appear on the market because of business reduction of haulers and other companies.

Despite that, here are given the factors allowing to minimize negative tendencies on the new truck market in 2022.

1. PARALLEL IMPORT LEGALIZATION

On the 6th May 2022, Russian Ministry of Industry and Trade published the list of vehicles and spare parts available for parallel import without right owner`s authorization. The allowed brand list included Mercedes-Benz, Renault, MAN, Volvo, DAF, Mitsubishi, Freightliner, Peterbilt, Kenworth and MACK Trucks. The parallel import provides foreign vehicles inflow on the Russian market, however, in connection with logistical complications, supply volumes do not tend to be significant in the current year and will not lead to significant market growth.

2. RUSSIAN, BELORUSSIAN AND CHINESE BRANDS CONSERVATION ON THE MARKET

KAMAZ continued working after imposed sanctions in February, but was forced to edit its manufacturing plan and will supply classic truck models on Russian components until the end 2022. In April 2022, KAMAZ reduced manufacturing by 15% to avoid overlaunching on the stores. Since the 26th of May KAMAZ has transmitted the essential part of managers and employees to 3-days working week.

GAZ is still manufacturing truck models with a high localization level. On the 5th of May the Government of Russian Federation intensified the financial support of GAZ and increased the subsidiary credit limit from 10 to 20 billion rubles. Up to the end of May companies of the GAZ Group worked in a complete week timetable, in June the timetable will be arranged in connection with current charge of manufacturers.

URALAZ is still working according to the standard timetable since February despite the problems with supplies of auto components used in manufacturing of several truck models due to high localization level of URAL trucks.

The Belorussian manufacturer MAZ also continues working and truck supplies into Russia.

Chinese OEMs are planning to continue truck supplies into Russia. Despite the logistical problems while transporting vehicles and auto components, these companies are going to stay on the Russian market and to organize sales.

Basic forecast scenario[1] supposes that sanction measures against Russia will be conserved up to the end of 2022. KAMAZ continues manufacturing trucks in «basic» versions on the April level in May-November 2022 and increases sales volumes in December. GAZ, URALAZ and MAZ conserve monthly sales levels in May-November on the level of March-April and increase them in the 4th quarter. Chinese brands will be able to establish the logistic chains for vehicle and spare components transport in the 2nd half of 2022 and will conserve sales volume on the April level or insignificantly lower. Trucks, whose supplies into Russia are prohibited, will be parallel imported in small volumes. Russian economy will show a depressed tendency up to the end of 2022, but without dramatic declines.

Optimistic forecast scenario supposes that sanction measures against Russia will be conserved up to the end of 2022, but will be gradually relented. KAMAZ continues manufacturing trucks in «basic» versions on the April level in May-November 2022 and increases sales volumes in the 4th quarter of 2022. GAZ, URALAZ and MAZ conserve monthly sales levels in May-June on the level of March-April and increase them in the 2nd half of the year. Trucks, whose supplies into Russia are prohibited, will be parallel imported in small volumes. Russian economy will show a depressed tendency up to the end of 2022, but several macroeconomic figures are going to grow in the second half of the year in comparison with March-April.

Pessimistic forecast scenario supposes that sanction measures against Russia will be conserved up to the end of 2022 and restricted. KAMAZ continues manufacturing trucks in «basic» versions in the volume lower than April level up to the end of the year. ГАЗ, УРАЛ и МАЗ сохранят апрельские объемы продаж до конца года. Trucks, whose supplies into Russia are prohibited, will be parallel imported in insignificant volumes. Russian economy will show a depressed tendency up to the end of 2022, several macroeconomic figures are going to decline in the second half of the year in comparison with March-April.

According to the basic forecast script, new truck sales will be reduced by 28,67% in 2022 in comparison with 2021 and will show 62,15 thousand. According to the optimistic forecast script, the sales will decrease by 25,49%, the sales results will show 64,92 thousand new trucks. According to the pessimistic forecast script the sales will decline by 35,15% up to 56,50 thousand.

New truck market forecast in 2022, thousands

Source: NAPI/ Russian Automotive Market Research

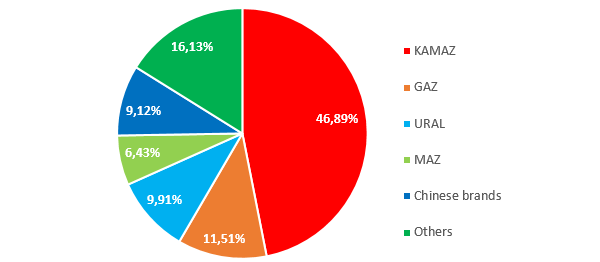

New truck market structure forecast in 2022

Source: NAPI/ Russian Automotive Market Research

____________________

[1] Here and further: except supplies for Russian Ministry of Defense, security departments.