17.07.2024 / New truck market forecast for 2024-2025

The new truck market forecast* is based on three scenarios: baseline, optimistic and pessimistic.

According to all three forecast scenarios, the following factors have a negative impact on the Russian automotive market.

1. Sanctions (EU, USA and other countries). After February 24, 2022, economic sanctions were imposed against the Russian Federation, which also affected the automotive market. There is a ban on the export of trucks, automotive components, spare parts, technologies and equipment to the Russian Federation. Nevertheless, the Russian automotive market has adapted to the new conditions: most of the vehicles supplied from countries that have announced sanctions against the Russian Federation have been replaced with Chinese, Russian and Belarusian ones. Moreover, a small amount of foreign vehicles is supplied under alternative import. Based on global political trends, we assume that sanctions against the Russian Federation will remain in 2024-2025.

2. High leasing and loan interest rates. On December 18, 2023, the Central Bank of the Russian Federation raised the key rate to 16%. This rate is valid in January-July 2024. With the growth of the key rate, the leasing and loan interest rates increased, which made these financial instruments less affordable. The negative impact of high leasing and loan interest rates will continue in the second half of 2024 and in 2025. Leasing and loan interest rates will depend on the key rate of the Central Bank of the Russian Federation, which may be increased in the second half of 2024 or in 2025.

3. The growth of recycling tax and stricter conditions for certification of imported vehicles. In August 2023, the recycling tax rates for trucks increased. Given that Russian manufacturers that have signed the SPIC are compensated for the recycling tax costs in the form of industrial subsidies, its increase primarily has a negative impact on prices for Chinese and other imported trucks. Also, beginning April 1, 2024, taxes and fees that were not paid due to underestimation of the customs value of vehicles imported into the Russian Federation from the EAEU countries are taken into account as part of the recycling tax. Further indexation of recycling tax rates is expected in the second half of 2024 and 2025.

Since October 1, 2023, certification of vehicles of those brands that have not stopped official deliveries to Russia and are not included in the list of brands allowed for parallel import has been carried out under the Technical regulations "On the safety of wheeled vehicles". Vehicle Type Approval is issued for vehicles of these brands, previously it was possible to issue Conclusion on the Assessment of a Single Vehicle. Legal entities are required to install the ERA-GLONASS system when importing vehicles. These requirements will remain in the second half of 2024 and 2025.

The growth of recycling tax and stricter conditions for certification of imported vehicles results in increase in truck prices, which has a negative impact on the market.

4. Release of pent-up demand. Many carriers, construction companies, and companies from other fields of activity purchased trucks in 2023 and will not intensively update and expand their fleets in 2024-2025.

5. Limited truck production. Since 2022, production of trucks of such foreign brands as Volvo, Mercedes-Benz, Mitsubishi Fuso, etc. has been discontinued in Russia. Since August 2023, the conditions for importing trucks in the Russian Federation have been tightening (growth of recycling tax, complication of certification of imported vehicles, etc.). In this regard, it is necessary to invest into the creation of new truck production facilities on the territory of the Russian Federation for the further market development.

Chinese manufacturers assemble or refine small volumes of trucks at the Russian facilities and do not announce their plans to invest into the development of full-fledged production in the Russian Federation in the coming years. The opening of production facilities in the Russian Federation by manufacturers from other countries is not planned during the period under review.

6. Tax reform in 2025. In 2025, tax reform will be carried out in the Russian Federation and the tax burden on companies and individual entrepreneurs will increase, which will lead to a further increase in prices for vehicles, spare parts, service, etc. In addition, financial capacity to upgrade truck fleets of a number of potential truck buyers may reduce.

Nevertheless, there are factors that make it possible to smooth out the negative trends in the new truck market in 2024-2025.

1. The growth of distances and volumes of cargo transportation. Due to the sanctions, the western direction for road transportation was actually closed. In 2022-2024, logistics companies began to actively use alternative ways of delivering goods to the Russian Federation (the route through the Republic of Belarus, the Turkish hub, the Silk Road (Russia – Kazakhstan – China), etc.).

Increased transportation distances lead to the growth in time of cargo transportation, which requires an additional number of trucks.

In 2024-2025, an increase in the vehicle cargo turnover is expected. According to Rosstat, in January – May 2024, the vehicle cargo turnover grew by 7.5%.

2. Development of the newly annexed territories to the Russian Federation (DPR, LPR, Kherson and Zaporozhye regions). New territories require the purchase of new trucks to carry out construction work, restore public infrastructure and ensure the transportation of goods.

3. State support measures for the truck market. State procurement of trucks.

In 2024, state support measures are in place for the truck market. In 2024, preferential leasing programs cover only tractor units and unmanned trucks, but not all trucks. 9 billion rubles were allocated for the implementation of the programs in 2024 (tractor units, unmanned trucks, buses, minibuses, and electric vehicles). In 2025, the preferential leasing program will continue with a budget of 11 billion rubles (for all types of vehicles that will fall under the program).

By the end of 2024, gas-powered trucks are expected to be purchased under Decree of the Government of the Russian Federation No. 669 dated 05/13/2020 and trucks running on all types of fuel - under the "Safe Quality Roads" national project. Trucks for agriculture will also be purchased under the state program for the development of agriculture and regulation of raw materials and food markets. However, under this program, only a small amount of equipment based on wheeled vehicles will be purchased (mainly tractor-based equipment and tracked vehicles are purchased).

4. Standard truck replacement cycles. In 2024 and 2025, old, worn-out and broken down trucks will be retired from the fleets and replaced with new ones.

According to all forecast scenarios, mainly Russian, Chinese and Belarusian brands will continue to be sold in the Russian truck market in 2024-2025. New vehicles imported under parallel import and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will also be sold.

The baseline forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation may be increased by 1-2 percentage points in the second half of 2024, which will lead to a further increase in the cost of loans and leasing,

- additional financing for state preferential leasing programs will not be allocated in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.5% on 2023, inflation will be 6.1%.

2025

- the key rate of the Central Bank of the Russian Federation in 2025 will remain at the level of the second quarter of 2024, lending and leasing of vehicles will remain expensive,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.6% on 2024, inflation will be 5.2%.

The optimistic forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation in the second half of 2024 will remain at the level of 16% and there will be no significant increase in the cost of lending and leasing,

- additional financing may be allocated for preferential leasing programs in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.7% on 2023, inflation will be 5.1%.

2025

- the key rate of the Central Bank of the Russian Federation may decrease by several percentage points in 2025, lending and leasing of vehicles will become more affordable,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.8% on 2024, inflation will be 4.2%.

The pessimistic forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation may be increased by more than 2 percentage points in the second half of 2024, which will lead to a further increase in the cost of loans and leasing of vehicles,

- additional financing for state preferential leasing programs will not be allocated in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.0% on 2023, inflation will be 7.1%.

2025

- the key rate of the Central Bank of the Russian Federation will continue to grow in 2025, therefore, interest rates on loans and lease will increase,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.4% on 2024, inflation will be 6.2%.

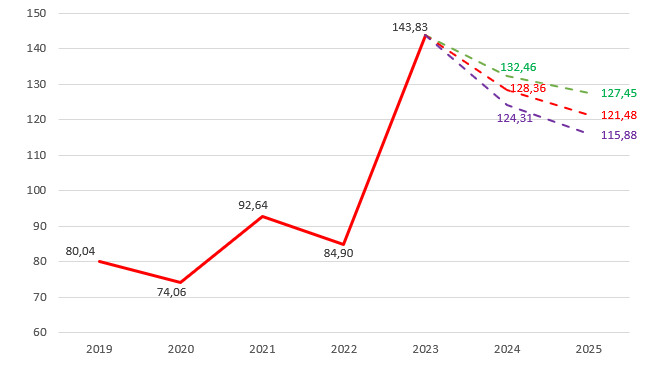

New truck sales forecast for 2024-2025

| Sales forecast, scenario |

Truck sales forecast in 2024, thousand units |

Growth/loss, 2024/2023, % |

Truck sales forecast in 2025, thousand units |

Growth/loss, 2025/2024, % |

| Optimistic scenario | 132.46 | -7.91 | 127.45 | -3.78 |

| Baseline scenario | 128.36 | -10.76 | 121.48 | -5.36 |

| Pessimistic scenario | 124.31 | -13.57 | 115.88 | -6.78 |

Source: NAPI (National Industrial Information Agency)

New truck market forecast till 2025, thousand units

Source: NAPI (National Industrial Information Agency)

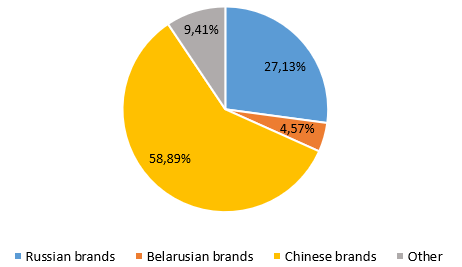

New truck market composition forecast in 2024, baseline scenario

Source: NAPI (National Industrial Information Agency)

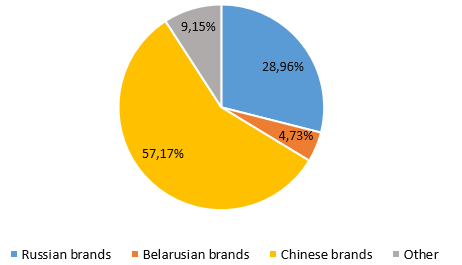

New truck market composition forecast in 2025, baseline scenario

Source: NAPI (National Industrial Information Agency)

[*] vehicles with a gross weight over 6 tons