08.11.2023 / New car sales forecast for 2024

Under the baseline forecast scenario, in 2024 new car sales will amount to 1,122 thousand units. Under the optimistic scenario, sales will reach 1,240 thousand units, while under the pessimistic scenario, they will reach 1,027 thousand units.

The baseline forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- AVTOVAZ will implement a production plan of 500 thousand cars for 86%.

- In 2024, the share of Chinese brands in the Russian market will slightly decrease on 2023. Sales of Chinese cars manufactured in Russia will continue (at the Haval Motor Manufacturing Rus LLC and AVTOTOR Group plants). Chinese cars will likely be manufactured at other sites. Import of Chinese cars will fall in 2024 caused by the increased recycling tax, other protective measures will likely be introduced to promote the Russian production development.

- Sales of Russian Moskvich 3e and Evolute electric vehicles, as well as imported electric vehicles will grow in 2024, but their market share will remain small. This is due to the low competitiveness of electric vehicles in relation to those running on traditional fuel. Prices for electric vehicles, especially imported ones, will remain at a fairly high level until the end of the year. For this reason, many consumers will prefer to buy similar vehicles running on traditional fuel. The service and maintenance of such vehicles is also quite expensive due to the low localization even of electric vehicles manufactured in the Russian Federation. Many service stations are not ready to service electric vehicles, as their specialists do not have enough competence to work with applications and software installed on them, diagnose their systems using special equipment, etc. There are problems with the operation of electric vehicles in winter conditions.

- The production of electric vehicles at the AVTOTOR Group plant, ATOM electric vehicles, the Almaz-Antey concern L-type electric vehicles in small volumes will likely begin.

- In 2024, sales of Moskvich cars running on traditional fuel will grow to 26 thousand units (65% of the plant's production plan of 40 thousand cars) primarily due to the government's initiative to "transfer" state employees to Russian cars.

- Parallel import of new cars through "third" countries bypassing sanctions will continue. In 2024, it will be more difficult to import new foreign cars into Russia than in 2023 due to increased recycling tax rates and stricter rules for car import by individuals. The list of cars allowed for parallel import and components to them may be reduced, since parallel import does not contribute to the development of car and component production in the Russian Federation.

- State support programs for the automotive market (preferential leasing, preferential auto loans, etc.) will be extended in 2024. The volume of their financing will remain unchanged on

- Beginning Q II 2024, the key rate may fall to the level of 7-8%. This will result in the increase in new car sales on credit and lease.

- The macroeconomic situation in Russia will remain unstable in 2024. GDP will grow slightly, by 1.5% on the level of 2023, inflation will be 5.1%.

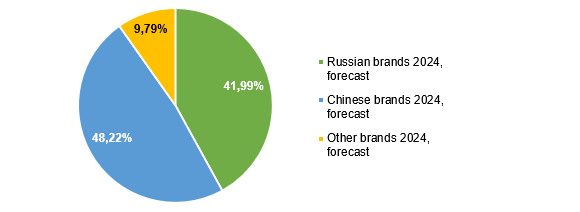

Under the baseline scenario, mainly Russian and Chinese brands will be sold in the Russian automotive market in 2024. New cars delivered under parallel import and cars of foreign brands manufactured on the territory of the PRC and "friendly" countries to the Russian Federation will also be sold.

Under the baseline scenario, 1,122 thousand new cars can be sold in 2024.

The optimistic forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- AVTOVAZ will implement a production plan of 500 thousand cars for 93%.

- In 2024, the share of Chinese brands in the Russian market will remain unchanged on 2023. Sales of Chinese cars manufactured in Russia will continue (at the Haval Motor Manufacturing Rus LLC and AVTOTOR Group plants). Chinese cars will likely be manufactured at other sites.

- Sales of Russian Moskvich 3e and Evolute electric vehicles, as well as imported electric vehicles will grow more than under the baseline scenario, but their market share will remain small.

- The production of electric vehicles at the AVTOTOR Group plant, ATOM electric vehicles, the Almaz-Antey concern L-type electric vehicles in small volumes will likely begin.

- In 2024, sales of Moskvich cars running on traditional fuel will grow to 28 thousand units (70% of the plant's production plan of 40 thousand cars) primarily due to the government's initiative to "transfer" state employees to Russian cars.

- Parallel import of new cars through "third" countries bypassing sanctions will continue, despite the difficulties, the number of cars imported will exceed that under the baseline scenario.

- State support programs for the automotive market (preferential leasing, preferential auto loans, etc.) will be extended in 2024. The volume of their financing will grow on

- Beginning Q II 2024, the key rate may fall to the level of 6-7%. This will result in the increase in new car sales on credit and lease.

- The macroeconomic situation in Russia will remain unstable in 2024. GDP will grow slightly, by 1.8% on the level of 2023, inflation will be 4.5%.

Under the optimistic scenario, mainly Russian and Chinese brands will be sold in the Russian automotive market in 2024. New cars delivered under parallel import and cars of foreign brands manufactured on the territory of the PRC and "friendly" countries to the Russian Federation will also be sold.

Under the optimistic scenario, 1,240 thousand new cars can be sold in 2024.

The pessimistic forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024 and will be tightened.

- AVTOVAZ will implement a production plan of 500 thousand cars for 83%.

- The share of Chinese brands in the Russian market will fall. Sales of Chinese cars manufactured in Russia will continue (at the Haval Motor Manufacturing Rus LLC and AVTOTOR Group plants). Chinese cars will likely be manufactured at other sites. Import of Chinese cars will fall in 2024 caused by the increased recycling tax.

- Sales of Russian Moskvich 3e and Evolute electric vehicles, as well as imported electric vehicles will grow less than under the baseline scenario, but their market share will remain small. The production of electric vehicles at the AVTOTOR Group plant, ATOM electric vehicles, the Almaz-Antey concern L-type electric vehicles will begin in 2025.

- In 2024, sales of Moskvich cars running on traditional fuel will grow to around 24 thousand units (60% of the plant's production plan of 40 thousand cars) primarily due to the government's initiative to "transfer" state employees to Russian cars.

- Parallel import of new cars through "third" countries bypassing sanctions will continue, but despite the difficulties and toughen sanctions, the number of cars imported will be lower than that under the baseline scenario.

- State support programs for the automotive market (preferential leasing, preferential auto loans, etc.) will be extended in 2024, but the volume of their financing will fall.

- Beginning Q II 2024, the key rate may fall to the level of 8-9%. This will result in the increase in new car sales on credit and lease.

- The macroeconomic situation in Russia will remain unstable in 2024. GDP will grow slightly, by 1.1% on the level of 2023, inflation will be 6.5%.

Under the pessimistic scenario, mainly Russian and Chinese brands will be sold in the Russian automotive market in 2024. New cars delivered under parallel import and cars of foreign brands manufactured on the territory of the PRC and "friendly" countries to the Russian Federation will also be sold.

Under the pessimistic scenario, 1,027 thousand new cars can be sold in 2024.

New car market composition forecast in 2024,

baseline scenario

Source: NAPI / National Industrial Information Agency