29.07.2024 / New bus market forecast for 2024-2025

The new bus market forecast is based on three scenarios: baseline, optimistic and pessimistic.

According to all three forecast scenarios, the following factors have a negative impact on the Russian automotive market.

1. Sanctions (EU, USA and other countries). After February 24, 2022, economic sanctions were imposed against the Russian Federation, which also affected the automotive market. There is a ban on the export of buses, automotive components for manufacturers, spare parts, technologies and equipment to the Russian Federation. The imposition of sanctions did not have as much impact on the bus production and market as in the segments of cars and trucks. Buses of Russian brands dominated the Russian market even before the sanctions were imposed. The dependence on foreign suppliers of automotive components and technologies was not so strong. After the sanctions were imposed, Russian buses retained their dominant position in the market, and the supply of Chinese vehicles increased, especially in the tourist coach segment due to the departure of other foreign brands.

Based on global political trends, we assume that sanctions against the Russian Federation will remain in 2024-2025.

2. High loan and leasing interest rates. On July 26, 2024, the Central Bank of the Russian Federation raised the key rate to 18% (from January 1 to July 25, 2024, the key rate was 16%). With the growth of the key rate, the loan and leasing interest rates increased, which made these financial instruments less affordable. The negative impact of high leasing and loan interest rates will continue in the second half of 2024 and in 2025. Leasing and loan interest rates will depend on the key rate of the Central Bank of the Russian Federation, which may be increased in 2024 or in 2025.[1]

3. The growth of recycling tax and stricter conditions for certification of imported vehicles. In August 2023, the recycling tax rates for buses increased. Given that Russian manufacturers that have signed the SPIC are compensated for the recycling tax costs in the form of industrial subsidies, its increase primarily has a negative impact on prices for Chinese buses. Also, beginning April 1, 2024, taxes and fees that were not paid due to underestimation of the customs value of vehicles imported into the Russian Federation from the EAEU countries are taken into account as part of the recycling tax. The recycling tax for buses is expected to increase on October 1, 2024. In 2025, further indexation of recycling tax coefficients is expected.

Since October 1, 2023, certification of buses of those brands that have not stopped official deliveries to Russia and are not included in the list of brands allowed for parallel import has been carried out under the Technical regulations "On the safety of wheeled vehicles". Vehicle Type Approval is issued for buses of these brands, previously it was possible to issue Conclusion on the Assessment of a Single Vehicle under a simplified procedure. Legal entities are required to install ERA-GLONASS systems when importing vehicles. These requirements will remain in the second half of 2024 and 2025.

The growth of recycling tax and stricter conditions for certification of imported vehicles results in increase in bus prices, which has a negative impact on the market.

4. Release of pent-up demand. The pent-up demand of tourist and other private companies in new buses was partially satisfied in 2023, and they will not intensively renew and expand their fleets in 2024-2025.

5. Tax reform in 2025. In 2025, tax reform will be carried out in the Russian Federation and the tax burden on companies and individual entrepreneurs will increase, which will lead to a further increase in prices for buses, spare parts, service, etc. Against the background of the growing tax burden, high auto loan and leasing rates, as well as prices raised by bus transportation companies, corporate owners will have reduced financial capacity to renew and expand their bus fleets.

Nevertheless, there are factors that make it possible to smooth out the negative trends in the new bus market in 2024-2025.

1. State support measures for the market of buses running on traditional types of fuel, gas engine fuel and electric buses.

In 2024, state support measures are in place for the bus market. In 2024, preferential leasing programs cover buses. 9 billion rubles were allocated for these programs in 2024 (tractor units, unmanned trucks, buses (including electric ones), minibuses, and electric cars). In 2025, the preferential leasing programs will continue with a budget of 11 billion rubles (for all types of vehicles that will fall under the program).

In 2024, buses will be subject to procurement under the program for converting vehicles to natural gas fuel under Decree of the Government of the Russian Federation No. 669 dated 05/13/2020, but the expected volumes of such procurement have not been officially published.

As part of the "Safe Quality roads" national project, 7.4 thousand buses, trolleybuses, electric buses and trams will be delivered to 81 regions of the Russian Federation in 2024. The specific amount of vehicles of each type that will be purchased under the program has not been published.

Bus procurement is also planned as part of the "School Bus" program. It is planned to allocate 10 billion rubles for the purchase of school buses in 2024. With this money, it is planned to purchase at least 3,000 school buses (minibuses and buses of various classes).

In 2024, in addition to preferential leasing, reduced recycling tax rates and a number of regional benefits apply to electric buses.

2. Bus and electric bus procurement programs in different regions. In 2024, 850 electric buses will be delivered to Moscow. By 2030, the Moscow government plans to purchase another 3,800 electric buses. Other regions are also planning to purchase electric buses at the expense of regional funds in 2024-2025.

Moreover, in 2024-2025, the regions will purchase buses running on natural gas and traditional types of fuel.

3. Standard bus replacement cycles. In 2024 and 2025, old, worn-out and broken down vehicles will be retired from the fleets of bus carriers and corporate vehicle owners and replaced with new ones.

4. Negative consumer expectations. In anticipation of rising prices for buses, a possible increase in loan and leasing interest rates, and a possible depreciation of the ruble, some carriers and corporate consumers will purchase buses at the current time so as not to overpay for them in the future. However, against the background of high overall inflation, not all companies will have the financial capacity to renew and expand their bus fleets.

This behavior of some consumers will remain in the second half of 2024 and in 2025 and will continue until the situation with prices, loan and leasing interest rates, and inflation in the automotive market stabilizes.

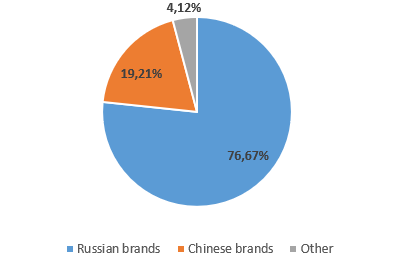

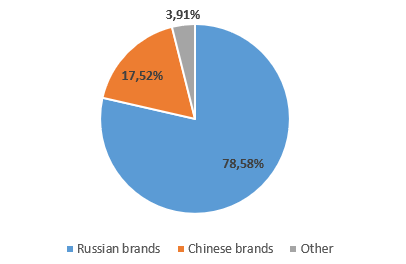

According to all forecast scenarios, Russian and Chinese brands will dominate in the Russian bus market in 2024-2025.

The baseline forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation may be increased from 18% by 1-2 percentage points in 2024, which will lead to a further increase in the cost of loans and leasing,[2]

- additional financing for state preferential leasing programs will not be allocated in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.5% on 2023, inflation will be 6.5%.

2025

- the key rate of the Central Bank of the Russian Federation in 2025 will remain at the level of the third-fourth quarters of 2024, lending and leasing of vehicles will remain expensive,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.6% on 2024, inflation will be 5.2%.

The optimistic forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation in the second half of 2024 will remain at the level of 18% and there will be no additional increase in the cost of lending and leasing,

- additional financing may be allocated for preferential leasing programs in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.7% on 2023, inflation will be 6.0%.

2025

- the key rate of the Central Bank of the Russian Federation may decrease by several percentage points in 2025, lending and leasing of vehicles will become more affordable,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.8% on 2024, inflation will be 4.2%.

The pessimistic forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation may be increased by more than 2 percentage points in 2024, which will lead to a further increase in the cost of loans and leasing of vehicles,

- additional financing for state preferential leasing programs will not be allocated in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.0% on 2023, inflation will be 7.0%.

2025

- the key rate of the Central Bank of the Russian Federation will continue to grow in 2025, therefore, loan and leasing interest rates will increase,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.4% on 2024, inflation will be 6.2%.

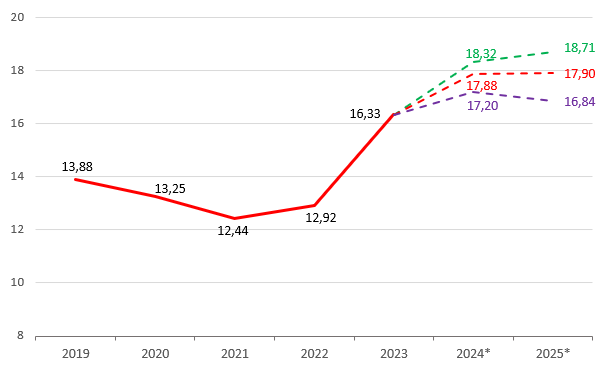

New bus sales forecast for 2024-2025

|

Sales forecast, |

Bus sales forecast in 2024, thousand units |

Growth/loss, 2024/2023, % |

Bus sales forecast in 2025, thousand units |

Growth/loss, 2025/2024, % |

| Optimistic scenario | 18.32 | 12.14 | 18.71 | 2.14 |

| Baseline scenario | 17.88 | 9.43 | 17.90 | 0.12 |

| Pessimistic scenario | 17.20 | 5.27 | 16.84 | -2.08 |

Source: NAPI (National Industrial Information Agency)

New bus market forecast till 2025, thousand units

* forecast

Source: NAPI (National Industrial Information Agency)

New bus market composition forecast in 2024, baseline scenario

Source: NAPI (National Industrial Information Agency)

New bus market composition forecast in 2025, baseline scenario

Source: NAPI (National Industrial Information Agency)

[1] The next meeting of the Board of Directors of the Bank of Russia, which will consider the issue of the key rate level, is scheduled for September 13, 2024.

[2] The Central Bank does not rule out an additional increase in the key rate after July 26, Central Bank Governor Elvira Nabiullina said at a press conference.