19.12.2023 / How many buses will be sold in 2024

HOW MANY BUSES WILL BE SOLD IN 2024

According to the baseline forecast scenario, in 2024, new bus sales will amount to 16.62 thousand units. Under the optimistic scenario, sales will reach 15.98 thousand units, while under the pessimistic scenario, they will reach 14.83 thousand units.

The baseline forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- In 2024, PAZ bus sales in the Russian market will grow by 3.65% on 2023.

- Sales of NEFAZ, LIAZ, VOLGABUS and other Russian buses will also grow slightly in 2024 compared to 2023, but the growth rate will be lower than that of PAZ buses. Bus purchases under federal and regional programs will continue. Some regions will start or continue purchasing KAMAZ, LIAZ, etc. electric buses in 2024.

- In 2024, sales of Chinese brands will grow slightly on 2023. They will be negatively affected by the increased recycling tax for these vehicles.

- In 2024, sales of MAZ buses in the Russian market will be slightly higher than those in 2023, but significant growth is not expected.

- Buses of other brands will be imported into Russia under parallel import in small volumes.

- State support measures for the bus market will be implemented in 2024. The volume of their financing in 2024 will increase on 2023.

- Starting Q II 2024, the key rate will likely decrease. This will result in the increase in new bus sales on credit and lease.

- The macroeconomic situation in Russia will remain unstable. In 2024, GDP may grow by 1.4% on 2023, inflation will be 6.2%, while bus passenger turnover may grow by 5.1%.

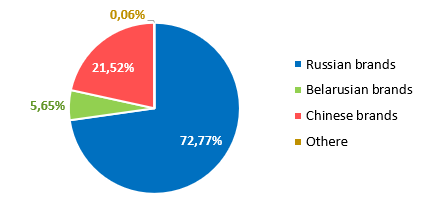

According to the baseline forecast scenario, mainly Russian and lesser Belarusian and Chinese brands will be sold in the Russian bus market in 2024. Sales of new buses imported under parallel imports and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will be small.

Under the baseline scenario, 15.98 thousand new buses may be sold in 2024.

The optimistic forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- In 2024, PAZ bus sales in the Russian market will grow by 4.68% on 2023.

- Sales of NEFAZ, LIAZ, VOLGABUS and other Russian buses in 2024 will exceed those in 2023 and will be higher than under the baseline scenario, but the growth rate will be lower than that of PAZ buses. Bus purchases under federal and regional programs will continue, the volume of purchases will be higher than under the baseline scenario. Some regions will start or continue purchasing KAMAZ, LIAZ, etc. electric buses in 2024 in higher volumes than under the baseline scenario.

- In 2024, sales of Chinese brands will grow slightly, by 2.27%, on 2023. They will be negatively affected by the increased recycling tax for these vehicles.

- In 2024, sales of MAZ buses in the Russian market will be slightly higher than those in 2023 (higher than under the baseline scenario), but significant growth is not expected.

- Buses of other brands will be imported into Russia under parallel import in small volumes.

- State support measures for the bus market will be fully implemented in 2024. The volume of their financing in 2024 will increase on

- Starting Q II 2024, the key rate will likely decrease. This will result in the increase in new bus sales on credit and lease.

- The macroeconomic situation in Russia will remain unstable. In 2024, GDP may grow by 1.7% on 2023, inflation will be 5.1%, while bus passenger turnover may grow by 5.9%.

According to the optimistic forecast scenario, mainly Russian and lesser Belarusian and Chinese brands will be sold in the Russian bus market in 2024. Sales of new buses imported under parallel imports and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will be small.

Under the optimistic scenario, 16.62 thousand new buses may be sold in 2024.

The pessimistic forecast scenario is based on the following prerequisites:

- Sanctions against the Russian Federation will remain until the end of 2024.

- In 2024, PAZ bus sales in the Russian market will slightly fall by 1.47% on 2023.

- Sales of NEFAZ, LIAZ, VOLGABUS and other Russian buses in 2024 will slightly fall on 2023. Bus purchases under federal and regional programs will continue, the volume of purchases will be lower than under the baseline scenario. Some regions will start or continue purchasing KAMAZ, LIAZ, etc. electric buses in 2024 in lower volumes than under the baseline scenario.

- In 2024, sales of Chinese brands will fall by 3.04%, on 2023. They will be negatively affected by the increased recycling tax for these vehicles.

- In 2024, sales of MAZ buses in the Russian market will be fall on 2023.

- Buses of other brands will be imported into Russia under parallel import in small volumes.

- State support measures for the bus market will be partially implemented in 2024.

- Starting Q II 2024, the key rate will likely decrease. This will result in the increase in new bus sales on credit and lease.

- The macroeconomic situation in Russia will remain unstable. In 2024, GDP may grow by 1.1% on 2023, inflation will be 8.3%, while bus passenger turnover may grow by 4.3%.

According to the pessimistic forecast scenario, mainly Russian and lesser Belarusian and Chinese brands will be sold in the Russian bus market in 2024. Sales of new buses imported under parallel imports and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will be small.

Under the pessimistic scenario, 14.83 thousand new buses may be sold in 2024.

New bus market composition forecast in 2024,

baseline scenario

Source: NAPI (National Industrial Information Agency)