21.05.2020 / Corporate vehicle market in April 2020

DownloadThe sharp decline in economic activity caused by the COVID-19 pandemic could not but affect the corporate vehicle market in April 2020. The drop in sales of all vehicle types varied from 29% to 63%.

The structure of demand for corporate vehicles by form of ownership and type of activity of the owner company also changed.

The new corporate car market

The new corporate car market

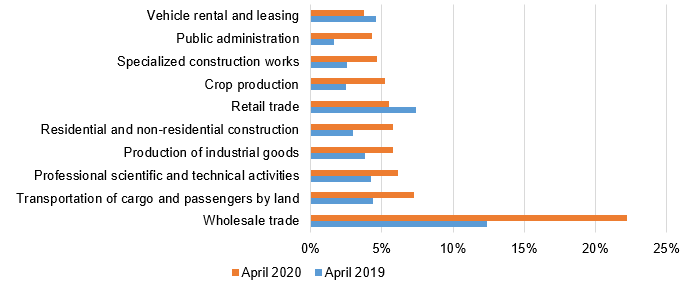

In April 2020, the demand of legal entities for new cars fell by 60% on April 2019. The decline in demand was typical for almost all types of activity except TOP-10 companies with the «Public administration» type of activity, demand for which increased by 7%. The share structure of demand showed significant reduction in the share of companies with the «Retail trade» and «Vehicle rental and leasing» types of activity. Companies engaged in the production of consumer goods did not enter TOP-10 in April 2020, while in April 2019 they accounted for 37.3% of the new corporate car market.

The new corporate car market by type of activity, units

|

Type of activity, ТОР-10 |

2019 (April) |

2020 (April) |

2020/2019 |

|

Wholesale trade |

2 726 |

1 960 |

-28% |

|

Transportation of cargo and passengers by land |

957 |

638 |

-33% |

|

Professional scientific and technical activities |

929 |

542 |

-42% |

|

Production of industrial goods |

845 |

512 |

-39% |

|

Residential and non-residential construction |

650 |

510 |

-22% |

|

Retail trade |

1636 |

487 |

-70% |

|

Crop production |

548 |

463 |

-16% |

|

Specialized construction works |

557 |

408 |

-27% |

|

Public administration |

356 |

381 |

7% |

|

Vehicle rental and leasing |

1 011 |

328 |

-68% |

|

Other |

11 832 |

2 605 |

-78% |

|

Total |

22 047 |

8 834 |

-60% |

Source: Russian Automotive Market Research

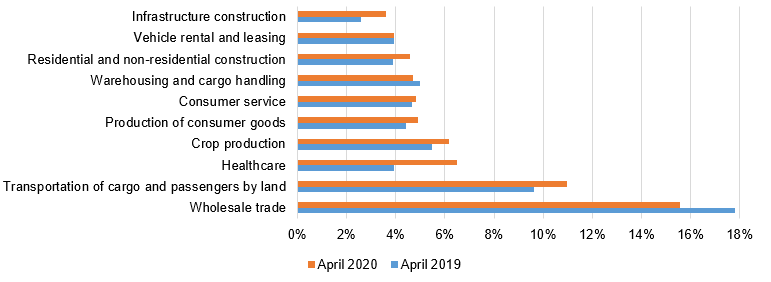

Demand for new corporate cars by type of activity

Source: Russian Automotive Market Research

|

Share |

ТОР-10, 2019 (April) |

ТОР-10, 2020 (April) |

Share |

|

37.3% |

Production of consumer goods |

Wholesale trade |

22.2% |

|

12.4% |

Wholesale trade |

Transportation of cargo and passengers by land |

7.2% |

|

7.4% |

Retail trade |

Professional scientific and technical activities |

6.1% |

|

4.6% |

Vehicle rental and leasing |

Production of industrial goods |

5.8% |

|

4.3% |

Transportation of cargo and passengers by land |

Residential and non-residential construction |

5.8% |

|

4.2% |

Professional scientific and technical activities |

Retail trade |

5.5% |

|

3.8% |

Production of industrial goods |

Crop production |

5.2% |

|

3.0% |

Rental and leasing of other property |

Specialized construction works |

4.6% |

|

2.9% |

Residential and non-residential construction |

Public administration |

4.3% |

|

2.7% |

Consumer service |

Vehicle rental and leasing |

3.7% |

|

82.8% |

ТОР-10 |

ТОР-10 |

70.5% |

|

17.2% |

Other |

Other |

29.5% |

|

100% |

TOTAL |

TOTAL |

100% |

Source: Russian Automotive Market Research

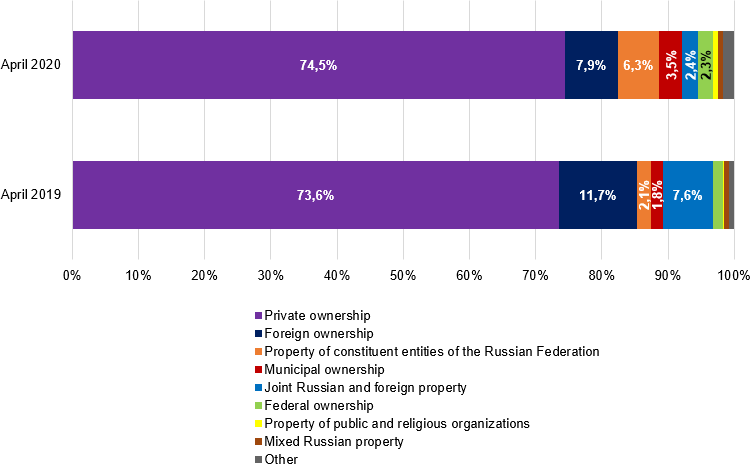

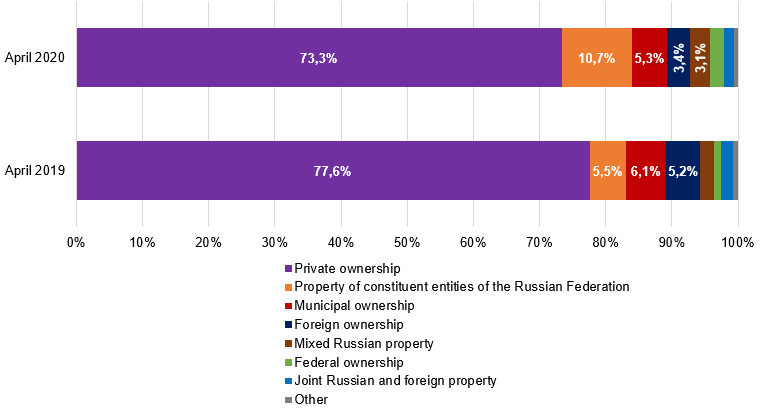

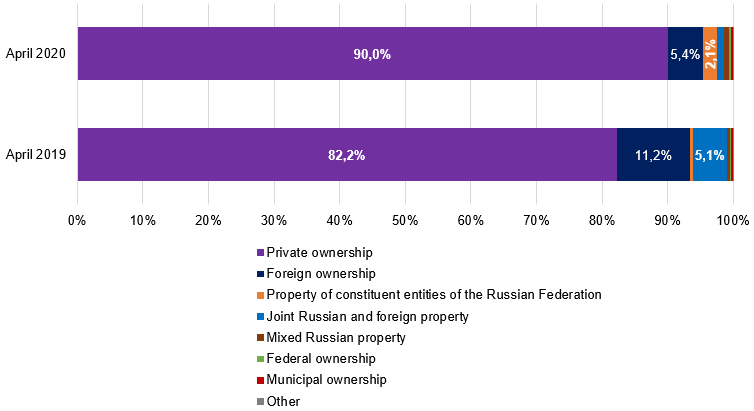

Demand for new corporate cars by form of ownership of the owner company

Source: Russian Automotive Market Research

The new corporate truck market

The new corporate truck market

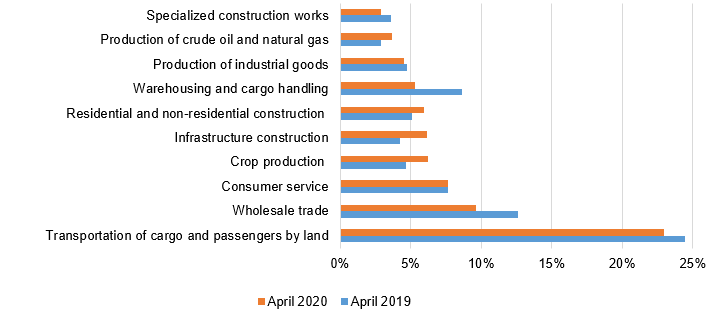

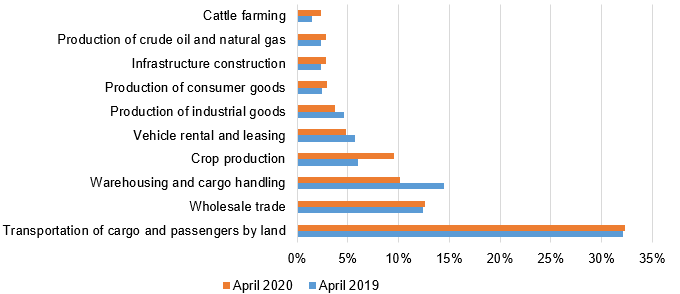

In April 2020, the demand of legal entities for new trucks fell by 32% on April 2019. The decline in demand was typical for almost all types of activity. The exception was «Cattle farming», «Public administration», «Logging» and other types of activity not included in TOP-10. The share structure of demand showed significant reduction in the share of companies with the «Wholesale trade» and «Warehousing and cargo handling» types of activity.

The new corporate truck market by type of activity, units

|

Type of activity, ТОР-10 |

2019 (April) |

2020 (April) |

2020/2019 |

|

Transportation of cargo and passengers by land |

1546 |

982 |

-36% |

|

Wholesale trade |

796 |

413 |

-48% |

|

Consumer service |

482 |

326 |

-32% |

|

Crop production |

295 |

265 |

-10% |

|

Infrastructure construction |

268 |

263 |

-2% |

|

Residential and non-residential construction |

324 |

253 |

-22% |

|

Warehousing and cargo handling |

547 |

226 |

-59% |

|

Production of industrial goods |

299 |

194 |

-35% |

|

Production of crude oil and natural gas |

181 |

156 |

-14% |

|

Specialized construction works |

229 |

124 |

-46% |

|

Other |

1 362 |

1 073 |

-21% |

|

TOTAL |

6 329 |

4 275 |

-32% |

Source: Russian Automotive Market Research

Demand for new corporate trucks by type of activity

Source: Russian Automotive Market Research

|

Share |

ТОР-10, 2019 (April) |

ТОР-10, 2020 (April) |

Share |

|

24.4% |

Transportation of cargo and passengers by land |

Transportation of cargo and passengers by land |

23.0% |

|

12.6% |

Wholesale trade |

Wholesale trade |

9.7% |

|

8.6% |

Warehousing and cargo handling |

Consumer service |

7.6% |

|

7.6% |

Consumer service |

Crop production |

6.2% |

|

5.1% |

Residential and non-residential construction |

Infrastructure construction |

6.2% |

|

4.7% |

Production of industrial goods |

Residential and non-residential construction |

5.9% |

|

4.7% |

Crop production |

Warehousing and cargo handling |

5.3% |

|

4.2% |

Infrastructure construction |

Production of industrial goods |

4.5% |

|

3.6% |

Specialized construction works |

Production of crude oil and natural gas |

3.6% |

|

3.0% |

Vehicle rental and leasing |

Specialized construction works |

2.9% |

|

78.6% |

ТОР-10 |

ТОР-10 |

74.,9% |

|

21.4% |

Other |

Other |

25.1% |

|

100.0% |

TOTAL |

TOTAL |

100.0% |

Source: Russian Automotive Market Research

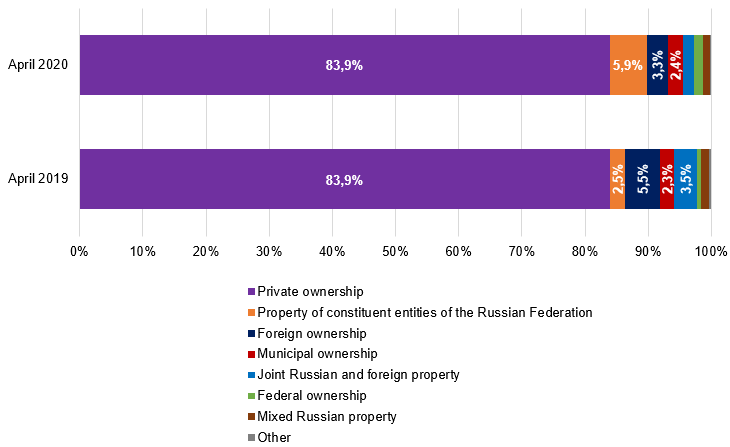

Demand for new corporate trucks by form of ownership of the owner company

Source: Russian Automotive Market Research

The new corporate light commercial vehicle market (LCV)

The new corporate light commercial vehicle market (LCV)

In April 2020, the demand of legal entities for new LCV fell by 39% on April 2019. The decline in demand was typical for almost all types of activity. The exception were organizations engaged in health care, as well as those with the «Public administration», «Logging» and a number of other types of activity not included in TOP-10. The share structure of demand showed noticeable reduction in the share of companies with the «Wholesale trade» type of activity. The share of companies with the «Healthcare» type of activity significantly increased. Companies engaged in retail trade were not included in TOP-10 in April 2020, while in April 2019 they accounted for 5.1% of the new corporate LCV market.

The new corporate LCV market by type of activity, units

|

Type of activity, ТОР-10 |

2019 (April) |

2020 (April) |

2020/2019 |

|

Wholesale trade |

1 244 |

663 |

-47% |

|

Transportation of cargo and passengers by land |

673 |

467 |

-31% |

|

Healthcare |

275 |

276 |

0% |

|

Crop production |

382 |

263 |

-31% |

|

Production of consumer goods |

308 |

209 |

-32% |

|

Consumer service |

325 |

206 |

-37% |

|

Warehousing and cargo handling |

348 |

200 |

-43% |

|

Residential and non-residential construction |

271 |

194 |

-28% |

|

Vehicle rental and leasing |

275 |

168 |

-39% |

|

Infrastructure construction |

180 |

153 |

-15% |

|

Other |

2 700 |

1 458 |

-46% |

|

TOTAL |

6 981 |

4 257 |

-39% |

Source: Russian Automotive Market Research

Demand for new corporate LCV by type of activity

Source: Russian Automotive Market Research

|

Share |

ТОР-10, 2019 (April) |

ТОР-10, 2020 (April) |

Share |

|

17.8% |

Wholesale trade |

Wholesale trade |

15.6% |

|

9.6% |

Transportation of cargo and passengers by land |

Transportation of cargo and passengers by land |

11.0% |

|

5.5% |

Crop production |

Healthcare |

6.5% |

|

5.1% |

Retail trade |

Crop production |

6.2% |

|

5.0% |

Warehousing and cargo handling |

Production of consumer goods |

4.9% |

|

4.7% |

Consumer service |

Consumer service |

4.8% |

|

4.4% |

Production of consumer goods |

Warehousing and cargo handling |

4.7% |

|

4.1% |

Production of industrial goods |

Residential and non-residential construction |

4.6% |

|

3.9% |

Healthcare |

Vehicle rental and leasing |

3.9% |

|

3.9% |

Vehicle rental and leasing |

Infrastructure construction |

3.6% |

|

64.1% |

ТОР-10 |

ТОР-10 |

65.8% |

|

35.9% |

Other |

Other |

34.2% |

|

100% |

TOTAL |

TOTAL |

100.0% |

Source: Russian Automotive Market Research

Demand for new corporate LCV by form of ownership of the owner company

Source: Russian Automotive Market Research

T he new corporate bus market

he new corporate bus market

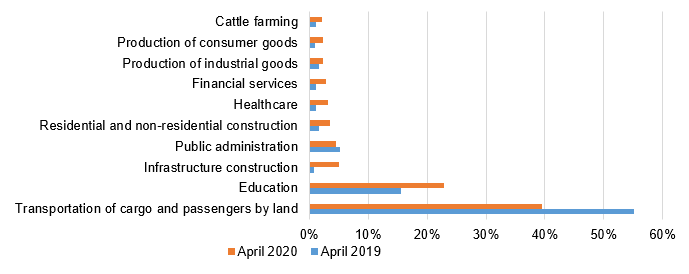

In April 2020, the demand of legal entities for new buses fell by 63% on April 2019. The decline in demand was typical for almost all types of activities. The exception in TOP-10 were organizations with «Infrastructure construction», «Healthcare», «Production of consumer goods» types of activity. The share structure of demand showed noticeable decrease in the share of companies with the «Transportation of goods and passengers by land» type of activity. The share of companies with the «Education» and «Infrastructure construction» types of activity significantly increased.

The new corporate bus market by type of activity, units

|

Type of activity, ТОР-10 |

2019 (April) |

2020 (April) |

2020/2019 |

|

Transportation of cargo and passengers by land |

696 |

184 |

-74% |

|

Education |

197 |

106 |

-46% |

|

Infrastructure construction |

10 |

23 |

130% |

|

Public administration |

65 |

21 |

-68% |

|

Residential and non-residential construction |

21 |

16 |

-24% |

|

Healthcare |

15 |

15 |

0% |

|

Financial services |

14 |

13 |

-7% |

|

Production of industrial goods |

21 |

11 |

-48% |

|

Production of consumer goods |

11 |

11 |

0% |

|

Cattle farming |

13 |

10 |

-23% |

|

Other |

198 |

55 |

-72% |

|

Total |

1261 |

465 |

-63% |

Source: Russian Automotive Market Research

Demand for new corporate buses by type of activity

Source: Russian Automotive Market Research

|

Share |

ТОР-10, 2019 (April) |

ТОР-10, 2020 (April) |

Share |

|

55.2% |

Transportation of cargo and passengers by land |

Transportation of cargo and passengers by land |

39.6% |

|

15.6% |

Education |

Education |

22.8% |

|

5.2% |

Public administration |

Infrastructure construction |

4.9% |

|

2.3% |

Vehicle rental and leasing |

Public administration |

4.5% |

|

2.1% |

Professional scientific and technical activities |

Residential and non-residential construction |

3.4% |

|

1.7% |

Crop production |

Healthcare |

3.2% |

|

1.7% |

Residential and non-residential construction |

Financial services |

2.8% |

|

1.7% |

Production of industrial goods |

Production of industrial goods |

2.4% |

|

1.6% |

Wholesale trade |

Production of consumer goods |

2.4% |

|

1.3% |

Social and cultural services |

Cattle farming |

2.2% |

|

88.3% |

ТОР-10 |

ТОР-10 |

88.2% |

|

11.7% |

Other |

Other |

11.8% |

|

100% |

TOTAL |

TOTAL |

100.0% |

Source: Russian Automotive Market Research

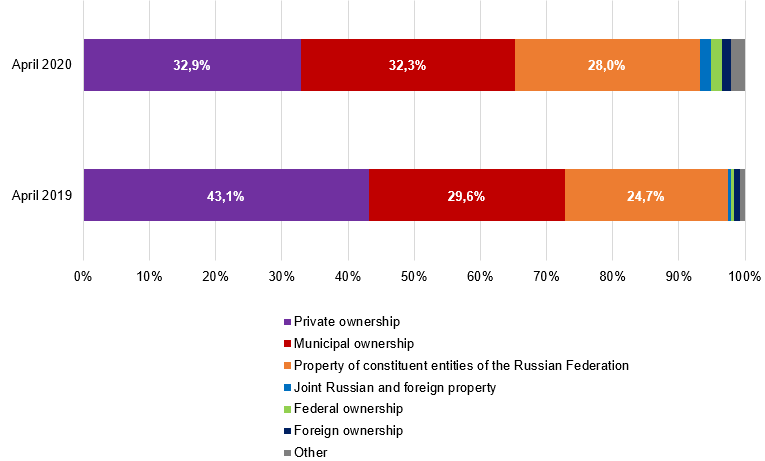

Demand for new corporate buses by form of ownership of the owner company

Source: Russian Automotive Market Research

The new corporate trailer market

The new corporate trailer market

In April 2020, the demand of legal entities for new trailers and semi-trailers fell by 29% on April 2019. The decline in demand was typical for almost all types of activity. The exception in TOP-10 were organizations with the «Crop production» and «Cattle farming» types of activity. The share structure of demand showed noticeable decrease in the share of companies with the «Warehousing and cargo handling» type of activity.

The new corporate trailer and semi-trailer market by type of activity, units

|

Type of activity, ТОР-10 |

2019 (April) |

2020 (April) |

2020/2019 |

|

Transportation of cargo and passengers by land |

768 |

550 |

-28% |

|

Wholesale trade |

297 |

215 |

-28% |

|

Warehousing and cargo handling |

346 |

173 |

-50% |

|

Crop production |

143 |

162 |

13% |

|

Vehicle rental and leasing |

136 |

81 |

-40% |

|

Production of industrial goods |

111 |

63 |

-43% |

|

Production of consumer goods |

58 |

50 |

-14% |

|

Infrastructure construction |

56 |

49 |

-13% |

|

Production of crude oil and natural gas |

55 |

48 |

-13% |

|

Cattle farming |

35 |

40 |

14% |

|

Other |

389 |

270 |

-31% |

|

TOTAL |

2 394 |

1 701 |

-29% |

Source: Russian Automotive Market Research

Demand for new corporate trailers and semi-trailers by type of activity

Source: Russian Automotive Market Research

|

Share |

ТОР-10, 2019 (April) |

ТОР-10, 2020 (April) |

Share |

|

32.1% |

Transportation of cargo and passengers by land |

Transportation of cargo and passengers by land |

32.3% |

|

14.5% |

Warehousing and cargo handling |

Wholesale trade |

12.6% |

|

12.4% |

Wholesale trade |

Warehousing and cargo handling |

10.2% |

|

6.0% |

Crop production |

Crop production |

9.5% |

|

5.7% |

Vehicle rental and leasing |

Vehicle rental and leasing |

4.8% |

|

4.6% |

Production of industrial goods |

Production of industrial goods |

3.7% |

|

2.5% |

Residential and non-residential construction |

Production of consumer goods |

2.9% |

|

2.4% |

Production of consumer goods |

Infrastructure construction |

2.9% |

|

2.4% |

Consumer service |

Production of crude oil and natural gas |

2.8% |

|

2.3% |

Infrastructure construction |

Cattle farming |

2.4% |

|

84.9% |

ТОР-10 |

ТОР-10 |

84.1% |

|

15.1% |

Other |

Other |

15.9% |

|

100% |

TOTAL |

TOTAL |

100.0% |

Source: Russian Automotive Market Research

Demand for new corporate trailers and semi-trailers by form of ownership of the owner company

Source: Russian Automotive Market Research