10.11.2025 / Why e-commerce won't save the LCV segment

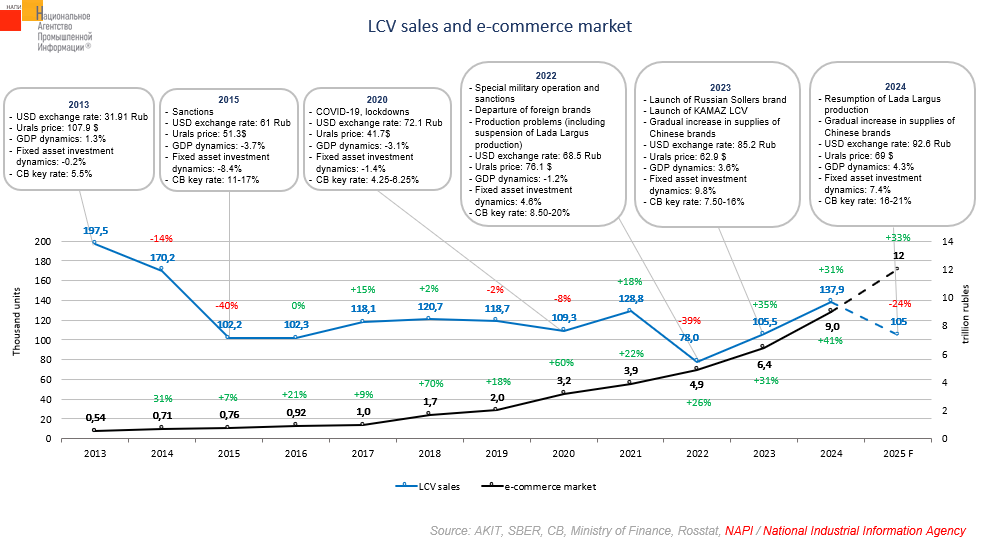

According to the marketing agency NAPI, LCV* sales are expected to reach 105 thousand units in 2025, which will be a 20%+ decline on the previous year. But why are LCV sales declining again? What caused their rise and fall in previous years? Why won't the e-commerce rise become a lifeline for them?

Let's fast forward to 2013, when nearly 200 thousand LCV were sold. High sales in 2013 and earlier can be explained by the "low base effect." The light commercial vehicle segment only practically emerged in Russia in 1994 when GAZelle production launched, so demand for LCV remained very high in 2013-2014. In 2014, it was boosted by the sharp ruble depreciation at the end of the year.

2015-2019 is a period of mature, saturated market. In 2015-2016, sales plummeted (-40% on 2014), driven by a sharp decline in oil prices, ruble depreciation, high sales in 2013-2014, and the adjustment period to the initial sanctions. Sales reached a plateau in 2017-2020 and slightly fluctuated, despite COVID-19 restrictions and another drop in oil prices in 2020.

Sales plummeted again in 2022 (-39%). The Russian automotive market found itself in a difficult situation: virtually all foreign brands that had occupied a significant market share left the market, while automotive component supplies to traditional Russian automakers ceased, leading to a decline in sales and production problems. For example, production of Lada Largus, one of the most popular models, was suspended. The market began to recover in 2023 (+35%) with the launch of the new Russian Sollers brand and production of KAMAZ light commercial vehicles, and in 2024 (+31%) with the resumption of Lada Largus production. "Pending demand" also played a significant role here.

So what's been happening with e-commerce all this time? It's been growing steadily. According to AKIT and SBER, the e-commerce market grew from 544 billion rubles in 2013 to 9 trillion rubles in 2024. It would seem that such growth in e-commerce should have led to increased demand for LCV for urban delivery. However, there is no clear correlation between these factors. For example, in 2018, the e-commerce market grew by 70%, while LCV sales only increased by 2%. And in 2022, LCV sales collapsed, despite the e-commerce market grew by 26%.

According to current forecasts, the e-commerce market could exceed 12 trillion rubles by 2025, which will be a third rise on the previous year. However, LCV sales will decline this year due to expensive leasing and auto loans, a cooling of business from buyers of vehicles in other segments, and other factors.

In summary, we can conclude that no matter what level e-commerce reaches, light commercial vehicle sales will unlikely reach the 2013 level. At least not in the coming years. Furthermore, other factors than e-commerce have a stronger impact on the market.

_____________________

*vehicles with GVW of up to 6 tons, including pickups