29.06.2020 / Updated new vehicle sales forecast for 2020-2021

Download The new vehicle forecast was updated taking into account new vehicle sales in May 2020.

The new vehicle forecast was updated taking into account new vehicle sales in May 2020.

When updating the forecast the resumption of production of all vehicle and component types in Russia and abroad, the gradual removal of restrictive measures, return of dealers to work on vehicle sales offline and the impact of government measures aimed to support the automotive market were taken into account.

In addition, two pessimistic scenarios were created for each vehicle type included in sales forecast for 2020-2021.

Pessimistic scenario No. 1 assumes that the main negative impact of the current epidemiological and economic situation will occur in 2020, while in 2021 the economy is expected to gradually recover due to rising oil prices, strengthening of the national currency and revival of business activity.

Pessimistic scenario No. 2 implies the possible second wave of COVID-19 epidemic expected in autumn of 2020 - winter of 2021, which will entail the re-introduction of restrictive measures and reduce the rate of economic recovery.

In addition, when calculating both variants of pessimistic forecast scenario it was taken into account that in 2020 advanced public procurement may result in the decrease in vehicle sales in 2021-2022: the recovery of demand for vehicles in the commercial sector will be slow and insufficient for positive market dynamics, while demand from the public sector will already be met.

Despite the suspension of dealerships, reduced business activity in most industries, quarantine measures and self-isolation, new vehicle sales in April and May 2020 were higher than it was expected. In April, orders for new vehicles placed in the first quarter of 2020 were fulfilled, while in the second half of the month and further in May deliveries under the state order began. Thus, the sales forecast for 2020 was revised in a positive direction compared to the sales forecast published in mid-April 2020. However, the market prospects in 2021 continue to be undefined for the reasons stated above.

C ars

ars

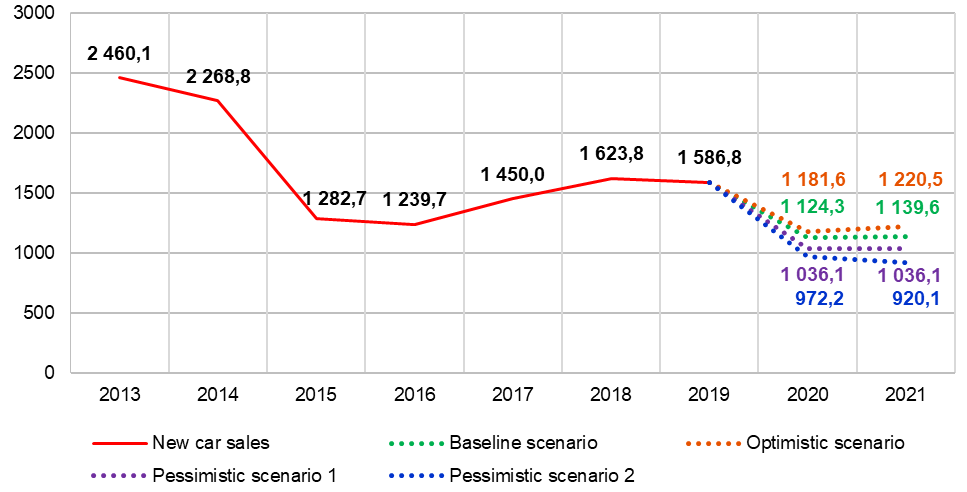

According to the baseline forecast scenario, in 2020 new car sales will decrease by 29.1% on 2019 and will amount to 1 124 300 units. Under the optimistic scenario, sales will fall by 25.5%, while under the pessimistic one - by 34.7%. If restrictive measures caused by the second wave of COVID-19 are re-introduced, the demand may be down by 38.7%.

New car sales till 2021, thousand units

Source: Russian Automotive Market Research

T rucks

rucks

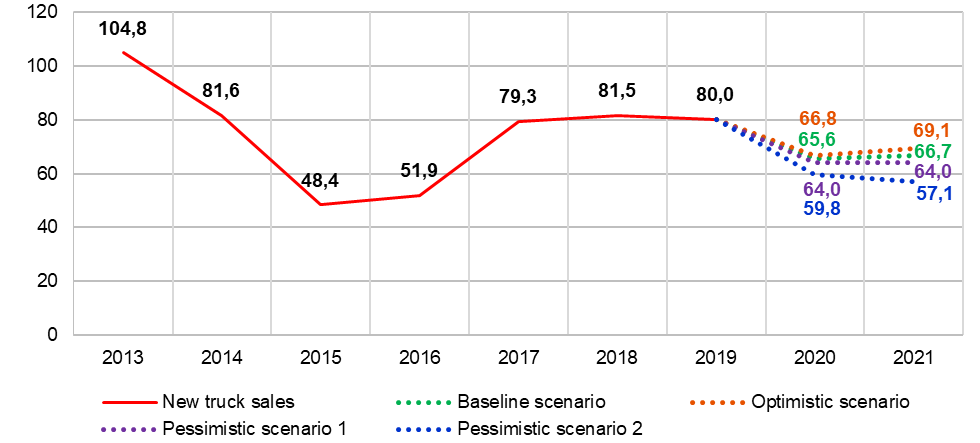

According to the baseline forecast scenario, in 2020 new truck sales will decrease by 18.0% on 2019 and will amount to 65.6 thousand units. Under the optimistic scenario, sales will fall by 16.5%, while under the pessimistic one - by 20.1%. If restrictive measures caused by the second wave of COVID-19 are re-introduced, the demand may be down by 25.3%.

The decline in demand for new trucks will mostly affect the BIG-7 brands (DAF, IVECO, MAN, MERCEDES-BENZ, RENAULT, SCANIA and VOLVO). The inevitable increase in prices for European trucks, initially more expensive, against the background of the decrease in the purchasing power of corporate and private buyers will result in the shift of demand towards Russian and Chinese brands. Moreover, government orders, which currently play a significant role in the truck market, primarily involve the purchase of Russian brands.

New truck sales till 2021, thousand units

Source: Russian Automotive Market Research

L ight commercial vehicles (LCV)

ight commercial vehicles (LCV)

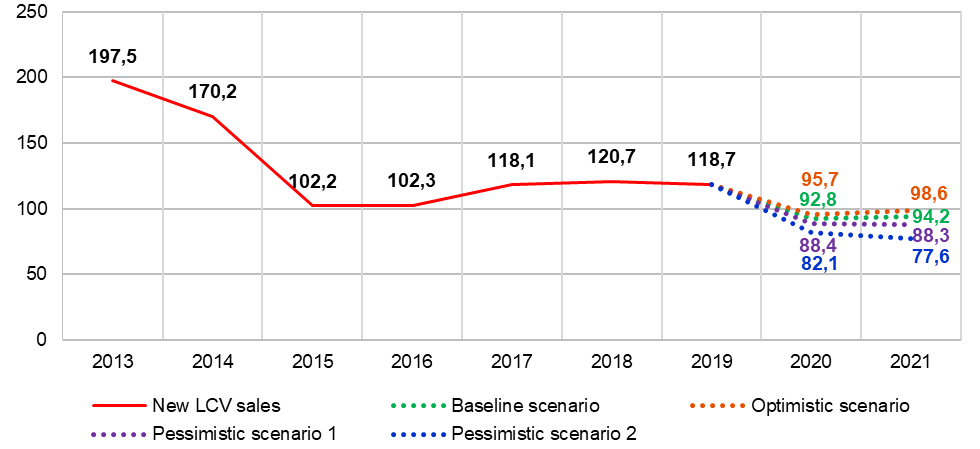

According to the baseline forecast scenario, in 2020 new light commercial vehicle sales will decrease by 21.9% on 2019 and will amount to 92.8 thousand units. Under the optimistic scenario, sales will fall by 19.4%, while under the pessimistic one - by 25.6%. If restrictive measures caused by the second wave of COVID-19 are re-introduced, the demand may be down by 30.9%.

New LCV sales till 2021, thousand units

Source: Russian Automotive Market Research