22.07.2024 / New car market forecast for 2024-2025

The new car market forecast is based on three scenarios: baseline, optimistic and pessimistic.

According to all three forecast scenarios, the following factors have a negative impact on the Russian automotive market.

1. Sanctions (EU, USA and other countries). After February 24, 2022, economic sanctions were imposed against the Russian Federation, which also affected the automotive market. There is a ban on the export of cars, electric cars, automotive components for automakers, spare parts, technologies and equipment to the Russian Federation. Nevertheless, the Russian automotive market has adapted to the new conditions: most of the cars supplied from countries that have announced sanctions against the Russian Federation have been replaced with Chinese and Russian ones. Moreover, a small amount of foreign cars is supplied under alternative import. Based on global political trends, we assume that sanctions against the Russian Federation will remain in 2024-2025.

2. High loan and leasing interest rates. On December 18, 2023, the Central Bank of the Russian Federation raised the key rate to 16%. This rate is valid in January-July 2024. With the growth of the key rate, the loan and leasing interest rates increased, which made these financial instruments less affordable. The negative impact of high leasing and loan interest rates will continue in the second half of 2024 and in 2025. Leasing and loan interest rates will depend on the key rate of the Central Bank of the Russian Federation, which may be increased in the second half of 2024 or in 2025.

3. Tightening the auto lending conditions for individuals with a high debt burden. On July 1, 2024, the Central Bank of the Russian Federation established surcharges to the risk ratios for auto loans with a debt burden index (DBI) exceeding 50%. Their value varies from 1.7 for DBI of 50-60% to 2 for DBI of over 80%. It will be more difficult for consumers with a high debt burden to get a loan, which will negatively affect car sales. At the same time, banks may continue to lend to some borrowers with high DBI, increasing loan terms for them and thereby reducing the debt burden.

Changes in the auto lending terms beginning July 1, 2024 will primarily have a negative impact on low-cost car sales, as they are mainly purchased by people with low income and high debt burden.

4. The growth of recycling tax and stricter conditions for certification of imported cars. In August 2023, the recycling tax rates for cars increased. Given that Russian automakers that have signed the SPIC are compensated for the recycling tax costs in the form of industrial subsidies, its increase primarily has a negative impact on prices for Chinese and other imported cars. Also, beginning April 1, 2024, taxes and fees that were not paid due to underestimation of the customs value of cars imported into the Russian Federation from the EAEU countries are taken into account as part of the recycling tax. The recycling tax for cars is expected to increase on October 1, 2024. In 2025, further indexation of recycling tax coefficients is expected.

Since October 1, 2023, certification of cars of those brands that have not stopped official deliveries to Russia and are not included in the list of brands allowed for parallel import has been carried out under the Technical regulations "On the safety of wheeled vehicles". Vehicle Type Approval is issued for cars of these brands, previously it was possible to issue Conclusion on the Assessment of a Single Vehicle under a simplified procedure. Legal entities are required to install the ERA-GLONASS system when importing cars. These requirements will remain in the second half of 2024 and 2025.

The growth of recycling tax and stricter conditions for certification of imported cars results in increase in car prices, which has a negative impact on the market.

5. Release of pent-up demand. Some consumers (individuals) have satisfied their need in new cars in 2023 and will not purchase new cars in 2024-2025. The pent-up demand of corporate customers in new cars was also partially satisfied in 2023, and they will not intensively renew and expand their fleets in 2024-2025.

6. Tax reform in 2025. In 2025, tax reform will be carried out in the Russian Federation and the tax burden on companies and individual entrepreneurs will increase, which will lead to a further increase in prices for cars, spare parts, service, etc. Against the background of the growing tax burden, high auto loan rates and rising prices, private consumers will postpone their decision to purchase cars. Corporate clients will have reduced financial capacity to renew their car fleets.

Nevertheless, there are factors that make it possible to smooth out the negative trends in the new car market in 2024-2025.

1. State support measures for the car and electric car market.

In 2024, state support measures are in place for the car and electric car market. First of all, these are preferential auto loan programs (cars and LCV, including electric cars), for which 17.3 billion rubles were allocated in 2024, and 23.1 billion rubles will be allocated in 2025.

Beginning 2024, preferential auto loan programs cover only electric cars. 9 billion rubles were allocated for these programs in 2024 (tractor units, unmanned trucks, buses, minibuses, and electric cars). In 2025, the preferential leasing programs will continue with a budget of 11 billion rubles (for all types of vehicles that will fall under the program).

Moreover, in 2024, cars will be subject to procurement under the program for converting vehicles to natural gas fuel under Decree of the Government of the Russian Federation No. 669 dated 05/13/2020, but the expected volumes of such procurement have not been officially published.

As for electric cars, reduced recycling tax rates, the possibility of free travel on toll roads and a number of regional benefits are valid in 2024, in addition to preferential auto loans and leasing. Nevertheless, electric car sales in the Russian market in 2024-2025 are expected to remain relatively low compared to those of traditional cars.

2. Standard car replacement cycles. In 2024 and 2025, old, worn-out and broken down cars will be retired from the fleets of private and corporate car owners and replaced with new ones.

3. Panic consumer expectations. In anticipation of rising prices for cars, a possible increase in loan and leasing interest rates, and a possible depreciation of the ruble, some corporate and private consumers will purchase cars at the current time so as not to overpay for them in the future. However, against the background of falling real incomes and high overall inflation, not all consumers will have the financial capacity to make such large purchases.

This behavior of some consumers will remain in the second half of 2024 and in 2025 and will continue until the situation with prices, loan and leasing interest rates, and inflation in the automotive market stabilizes.

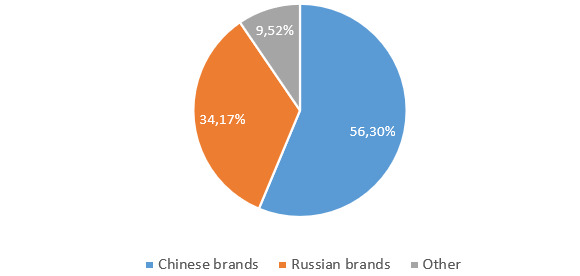

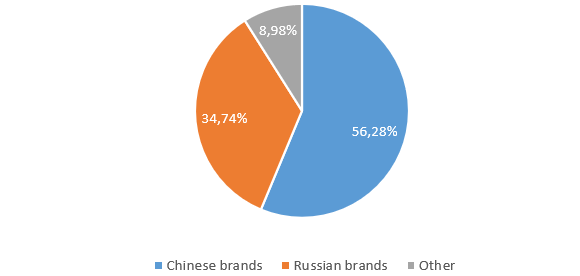

According to all forecast scenarios, Russian and Chinese brands will dominate in the Russian car market in 2024-2025. New cars imported under parallel import and those of foreign brands manufactured on the territory of the People's Republic of China and "friendly" countries to the Russian Federation will also be sold.

The baseline forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation may be increased by 1-2 percentage points in the second half of 2024, which will lead to a further increase in the cost of loans and leasing,

- additional financing for state preferential auto loan and leasing programs will not be allocated in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.5% on 2023, inflation will be 6.1%.

2025

- the key rate of the Central Bank of the Russian Federation in 2025 will remain at the level of the second quarter of 2024, lending and leasing of cars will remain expensive,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.6% on 2024, inflation will be 5.2%.

The optimistic forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation in the second half of 2024 will remain at the level of 16% and there will be no significant increase in the cost of lending and leasing,

- additional financing may be allocated for preferential auto loan and leasing programs in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.7% on 2023, inflation will be 5.1%.

2025

- the key rate of the Central Bank of the Russian Federation may decrease by several percentage points in 2025, lending and leasing of cars will become more affordable,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.8% on 2024, inflation will be 4.2%.

The pessimistic forecast scenario assumes the following:

2024

- the key rate of the Central Bank of the Russian Federation may be increased by more than 2 percentage points in the second half of 2024, which will lead to a further increase in the cost of loans and leasing of cars,

- additional financing for state preferential auto loan and leasing programs will not be allocated in the second half of 2024,

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.0% on 2023, inflation will be 7.1%.

2025

- the key rate of the Central Bank of the Russian Federation will continue to grow in 2025, therefore, interest rates on loans and leasing will increase,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.4% on 2024, inflation will be 6.2%.

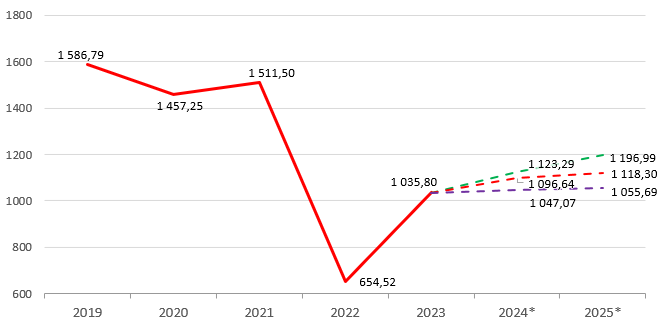

New car sales forecast for 2024-2025

| Sales forecast, scenario |

Car sales forecast in 2024, thousand units |

Growth/loss, 2024/2023, % |

Car sales forecast in 2025, thousand units |

Growth/loss, 2025/2024, % |

| Optimistic scenario | 1,123.29 | 8.45 | 1,196.98 | 6.56 |

| Baseline scenario | 1,096.64 | 5.87 | 1,118.31 | 1.98 |

| Pessimistic scenario | 1,047.07 | 1.09 | 1,055.69 | 0.82 |

Source: NAPI (National Industrial Information Agency)

New car market forecast till 2025, thousand units

* forecast

Source: NAPI (National Industrial Information Agency)

New car market composition forecast in 2024, baseline scenario

Source: NAPI (National Industrial Information Agency)

New car market composition forecast in 2025, baseline scenario

Source: NAPI (National Industrial Information Agency)

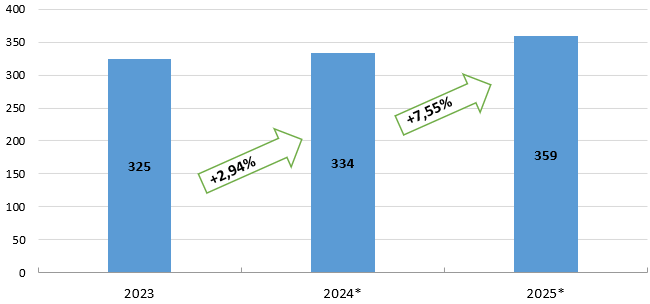

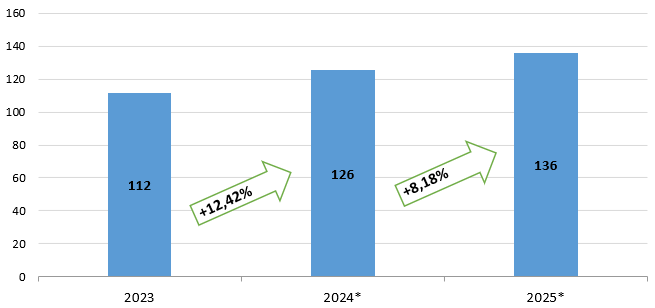

New LADA car sales forecast for 2024-2025, baseline scenario

* forecast

Source: NAPI (National Industrial Information Agency)

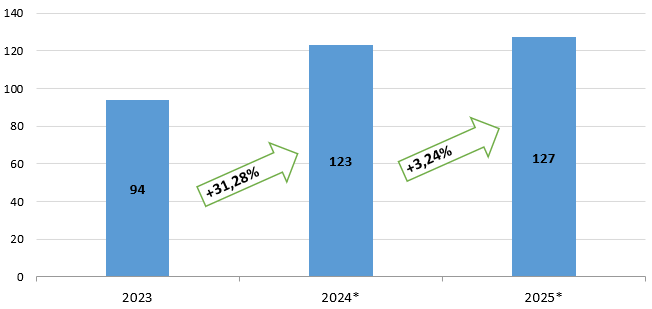

New HAVAL car sales forecast for 2024-2025, baseline scenario

* forecast

Source: NAPI (National Industrial Information Agency)

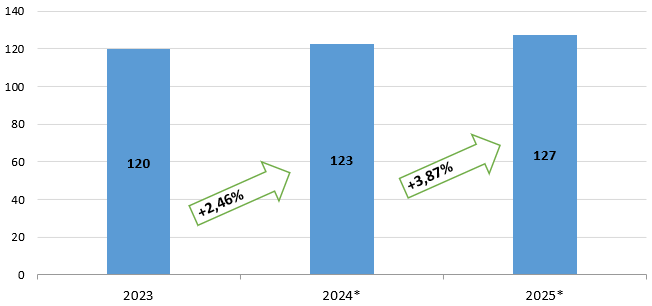

New GEELY car sales forecast for 2024-2025, baseline scenario

* forecast

Source: NAPI (National Industrial Information Agency)

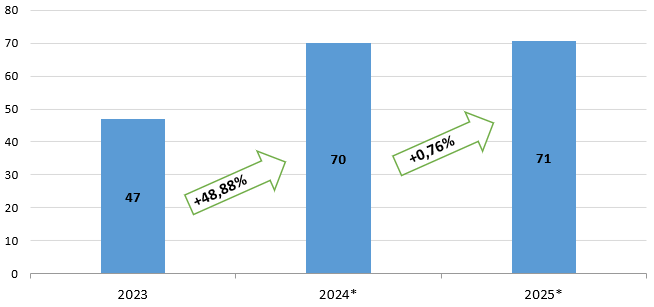

New CHERY car sales forecast for 2024-2025, baseline scenario

* forecast

Source: NAPI (National Industrial Information Agency)

New CHANGAN car sales forecast for 2024-2025, baseline scenario

* forecast

Source: NAPI (National Industrial Information Agency)