21.04.2020 / How much can car and commercial vehicle sales fall?

Download The new vehicle market forecast is based on three scenarios: baseline, optimistic and pessimistic, taking into account the possible duration of the quarantine: till mid-May, till the end of May, till the end of June 2020.

The new vehicle market forecast is based on three scenarios: baseline, optimistic and pessimistic, taking into account the possible duration of the quarantine: till mid-May, till the end of May, till the end of June 2020.

When forming the new vehicle sales forecast for 2020-2021 projected values of Urals oil price, the national currency exchange rate and the expected GDP growth were taken into account.

The suspension of production of all types of vehicles and components in Russia and abroad was also taken into consideration.

In addition, two scenarios were created for each vehicle type for 2021.

Scenario No. 1 assumes that the main negative impact of the current epidemiological and economic situation will occur in 2020, while in 2021 the economy is expected to gradually recover due to rising oil prices, strengthening of the national currency and revival of business activity.

Scenario No. 2 implies that the negative impact of the current epidemiological and economic situation will continue in 2021 and rates of the market recovery will be low.

In 2020-2021 new vehicle sales will be suppressed due the fact that in 2020 and partially in 2021 there will be an inflow of «fresh» used vehicles in the market because owners might consider them excessive because of bankruptcies, business closures and reduced park workload. Individuals will also get rid of «fresh» cars because they might fail to pay back on the loan, facing reduced income and need for cash. Small and medium-sized businesses and individuals can buy a cheaper «fresh» used vehicle instead of a new one.

Cars

Cars

The following factors were taken into account when forming the new car sales forecast:

• state programs aimed to support the automotive market,

• forced downtime of dealers caused by quarantine measures depending on the quarantine duration,

• expected growth in the number of the unemployed,

• significant decrease in consumer confidence,

• debt load of private and corporate buyers,

• expected decrease in solvency of private and corporate buyers,

• decrease in purchases in the corporate segment,

• rising prices for new cars caused by the ruble depreciation.

During the period of self-isolation, the weak development of online sales did not allow dealers to actively sell cars and prevent the market from a significant reduction. On the one hand, dealers are not ready – there are few well-functioning payment systems, it is rarely possible to fully pay for the car online, there are very few convenient offers of a fully prepared service – online credit, online lease, online insurance, online payment and registration in the traffic police.

On the other hand, the consumer is not ready to purchase a car completely online – from selection to payment. It is important for many buyers to inspect the car and have a test drive. Moreover, the consumer prefers to have a conventional paper contract of sale when purchasing an expensive product.

In order to fully convert the purchase process to the online form dealers will have to do a lot of work and overcome the prejudices of a significant part of car owners.

About 50% of new cars are sold on credit. In January-February 2020, NBCH announced the increase in the number of car loans granted compared to the same period of 2019. However, the growth in car loans was accompanied by a decrease in the share of approved loan applications. In January-February 2019 banks approved about 47% of all applications for car loans, whereas over the first two months of 2020 only 34% of applications for car loans were approved. The percentage of approved applications in 2020 and 2021 is expected to be lower than in previous periods. On the other hand, reduced incomes and uncertainty about the future will prevent individuals from buying cars on credit. These factors will also push the new car market down.

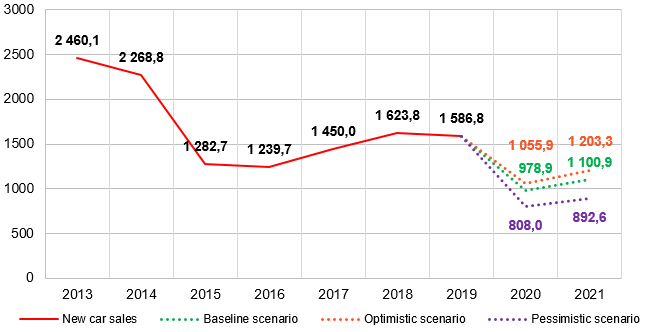

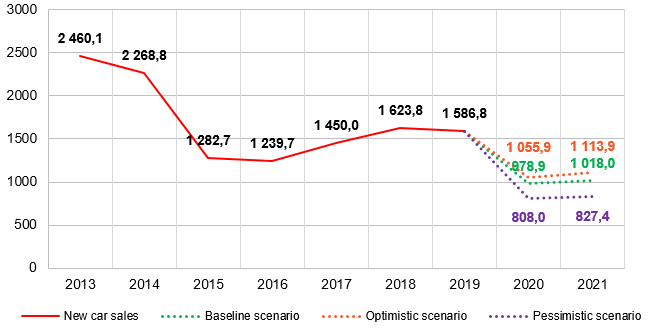

According to the baseline scenario, in 2020 new car sales will fall by 38.3% on 2019 and will amount to 978.9 thousand units. Under the optimistic scenario, sales will decrease by 33.5%, while under the pessimistic one - by 49.1%.

New car sales till 2021, thousand units Scenario 1

Source: Russian Automotive Market Research

New car sales till 2021, thousand units Scenario 2

Source: Russian Automotive Market Research

Source: RF Ministry of Economic Development and Trade, World Bank, Goldman Sachs, Central Bank of the Russian Federation, Forbes, Center of Development Institute, Russian Automotive Market Research

Trucks

Trucks

The following factors were taken into account when forming the new truck sales forecast:

• state programs aimed to support the automotive market,

• public procurement of trucks for utilities sector and infrastructure projects

мdifferent recovery rates for consuming industries: industries were divided into groups by the degree of a negative impact of the current situation on demand and recovery.

Group No. 1 includes industries that were less negatively affected, such as mining, agriculture and others; higher recovery rates are expected for this group of industries.

Group No. 2 includes industries that were negatively affected to a greater extent, such as cargo transportation, chemical manufacturing, etc.

Group No. 3 includes types of activity that are most vulnerable in the current situation, for example, leisure and entertainment, production of textiles, leather and fur products, etc.

• different rates of consumer recovery: consumers were divided into groups - private, small and medium-sized businesses, state companies, holdings,

• corporate customers' debt load,

• availability of «fresh» used trucks caused by the bankruptcy of companies, decline in business activity of companies, individual entrepreneurs,

• expected decrease in the solvency of potential corporate buyers,

• increase in prices for new trucks caused by the ruble depreciation and significant growth of prices for trucks of foreign brands.

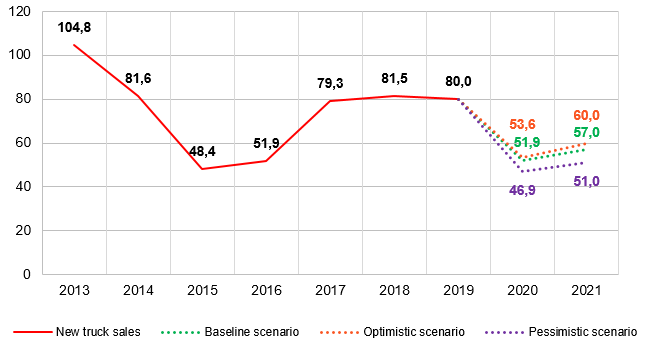

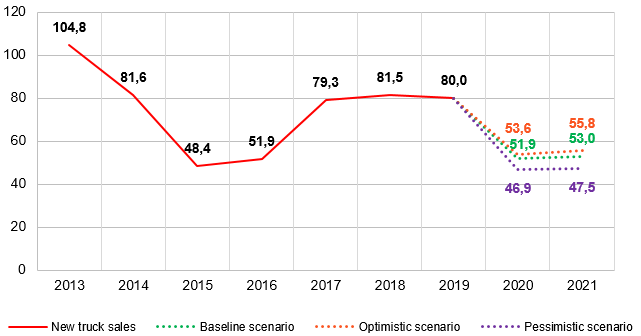

According to the baseline forecast scenario, in 2020 new truck sales will decrease by 35.1% on 2019 and will amount to 51.9 thousand units. Under the optimistic scenario, sales will fall by 33.0%, while under the pessimistic one - by 41.4%.

New truck sales till 2021, thousand units Scenario 1

Source: Russian Automotive Market Research

New truck sales till 2021, thousand units Scenario 2

Source: Russian Automotive Market Research

L ight commercial vehicles (LCV)

ight commercial vehicles (LCV)

The following factors were taken into account when forming the new LCV sales forecast:

• state programs aimed to support the automotive market,

• public procurement of ambulances and school buses,

• different recovery rates for consuming industries: industries were divided into groups by the degree of negative impact of the current situation on demand and recovery.

Group No. 1 includes industries that were less negatively affected, such as healthcare, food production and others.

Group No. 2 includes industries that were negatively affected to a greater extent, such as mail and courier services, etc.

Group No. 3 includes activities that are most vulnerable in the current situation, for example, transactions with movable and immovable property, the field of art, etc.

• different rates of consumer recovery: consumers were divided into groups - private, small and medium-sized businesses, state companies, holdings,

• decrease in the number of micro-enterprises, small and medium-sized businesses - the key consumers of light commercial vehicles,

• expected growth in the number of the unemployed,

• debt load of private and corporate buyers,

• availability of «fresh» used LCV caused by the bankruptcy of companies, decrease in business activity of companies, individual entrepreneurs

• expected decrease in the solvency of private and corporate buyers,

• increase in prices for new vehicles caused by the ruble depreciation.

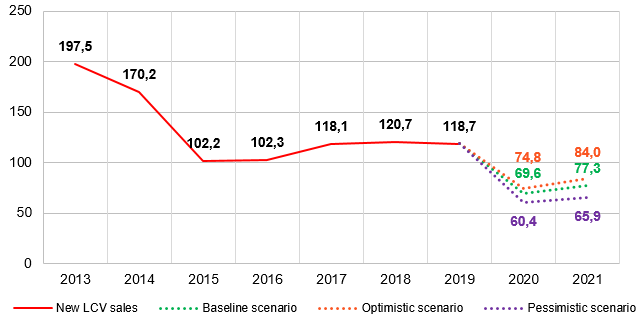

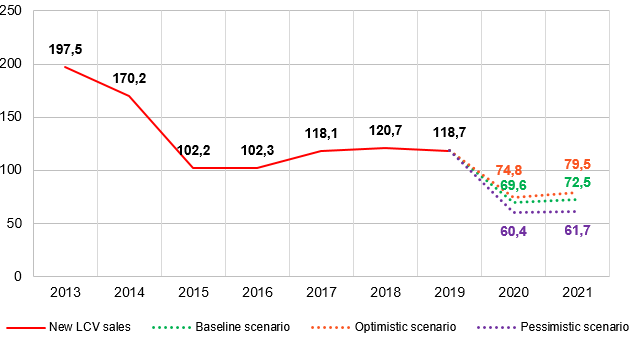

According to the baseline scenario, in 2020 new light commercial vehicle sales will decrease by 41.4% on 2019 and will amount to 69.6 thousand units. Under the optimistic scenario, sales will fall by 37.0%, while under the pessimistic one - by 49.1%.

New LCV sales till 2021, thousand units Scenario 1

Source: Russian Automotive Market Research

New LCV sales till 2021, thousand units Scenario 2

Source: Russian Automotive Market Research