23.12.2024 / How many semi-trailers will be sold in 2025

The new semi-trailer market forecast is based on three scenarios: baseline, optimistic and pessimistic.

According to all three forecast scenarios, the following factors had a negative impact on the Russian automotive market:

1. Sanctions (EU, USA and other countries). After February 24, 2022, economic sanctions were imposed against the Russian Federation, which also affected the automotive market. There is a ban on the export of trailers, spare parts, technologies and equipment to the Russian Federation. Based on global political trends, we assume that sanctions against the Russian Federation will remain in 2024-2025. The impact of sanctions on new trailer sales is not high. Some European brands still supply their trailers to the Russian market under direct or alternative import, while semi-trailers of those brands that have completely stopped supplying them to Russia have been replaced with trailers produced by Russian manufacturers and manufacturers from "friendly" countries.

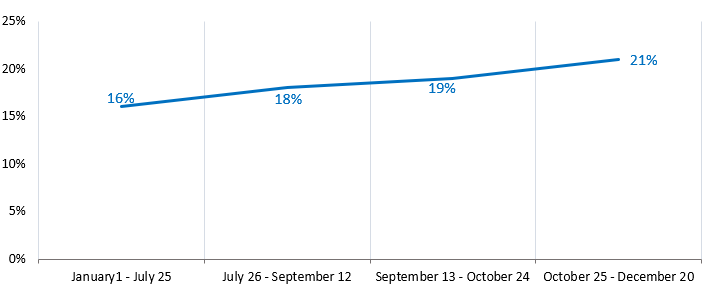

2. High loan and leasing interest rates. Since the beginning of 2024, there has been a gradual increase in the key rate of the Central Bank of the Russian Federation (see chart). The last increase in the key rate took place on October 25, 2024. The Central Bank of the Russian Federation raised the key rate to 21%. This rate is valid until February 14, 2025. With the growth of the key rate, the loan and leasing interest rates increased, which made these financial instruments less affordable. The negative impact of high leasing and loan interest rates will remain until the end of 2024 and in 2025. Leasing and loan interest rates will depend on the key rate of the Central Bank of the Russian Federation, which may be increased in 2025.

Change in the key rate of the Central Bank of the Russian Federation in 2024

Source: Central Bank of the Russian Federation

3. The growth of recycling tax for imported trailers. Beginning April 1, 2024, the Government of the Russian Federation decided to include taxes and fees that were not paid due to underestimation of the customs value of vehicles imported into the Russian Federation from the EAEU countries into the recycling tax. On October 1, 2024, recycling tax rates significantly increased for all vehicle types, including semi-trailers. On January 1, 2025, recycling tax rates will be indexed again.

The growth of recycling tax results in increase in trailer prices, which has a negative impact on the market.

4. The lack of state programs aimed to support the trailer market. State programs of preferential auto loans and preferential leasing (including leasing of special-purpose vehicles) valid in the Russian Federation do not cover trailers. Based on the current legislation, trailer manufacturers have the right to subsidize part of the production costs. These subsidies apply only to trailer manufacturers with which the relevant SPIC has been concluded.

5. Tax reform in 2025. In 2025, tax reform will be carried out in the Russian Federation and the tax burden on companies and individual entrepreneurs will increase. It will lead to a further increase in prices for semi-trailers, spare parts, service, etc.

On January 1, 2025, excise taxes on gasoline and diesel fuel, as well as fares for travel on federal public roads by vehicles with GVW of over 12 tons (Platon system) will be indexed, which will have a negative impact on the total cost of ownership of trucks with semi-trailers.

Against the background of the growing tax burden, high auto loan and leasing rates and rising prices, a number of companies and individual entrepreneurs will have reduced financial capacity to renew their fleets and purchase semi-trailers.

Nevertheless, there are factors that make it possible to smooth out the negative trends in the new semi-trailer market in 2024-2025.

1. Financial programs from trailer manufacturers. Against the background of the key rate increase, trailer manufacturers and leasing companies are developing and offering their loan and leasing programs to consumers at more attractive interest rates than standard rates from banks and leasing companies.

2. Standard trailer replacement cycles. In 2024 and 2025, old, worn-out and broken down trailers will be retired from the fleets of private and corporate vehicle owners and replaced with new ones.

3. The growth of distances and volumes of cargo transportation. Due to the sanctions, the western direction for road transportation was actually closed. EU countries have stopped allowing vehicles registered in Russia and Belarus since April 2022, and the ban has even affected transit traffic (with the exception of transit to the Kaliningrad region). In 2022-2024, logistics companies began to actively use alternative ways of delivering goods to the Russian Federation (the route through the Republic of Belarus, the Turkish hub, the Silk Road (Russia – Kazakhstan – China), etc.). Increased transportation distances lead to the growth in time of cargo transportation, which requires an additional number of trucks and semi-trailers.

Moreover, an increase in the vehicle cargo turnover is expected in 2024-2025. In January – October 2024, the vehicle cargo turnover (all types of vehicles) increased by 5.9%.

4. Development of the newly annexed territories to the Russian Federation (DPR, LPR, Kherson and Zaporozhye regions). New territories require the purchase of new trailers to ensure transportation of goods.

According to all forecast scenarios, mainly Russian semi-trailers, trailers imported under alternative import, and vehicles from "friendly" countries will continue to be sold in the Russian semi-trailer market in 2024-2025.

The baseline forecast scenario assumes the following:

2024

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 3.0% on 2023, inflation will be 8.2%.

2025

- the key rate of the Central Bank of the Russian Federation in 2025 will remain at the level of December 2024, lending and leasing of vehicles will remain expensive,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.6% on 2024, inflation will be 5.0%.

The optimistic forecast scenario assumes the following:

2024

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 3.3% on 2023, inflation will be 8.0%.

2025

- the key rate of the Central Bank of the Russian Federation may decrease by several percentage points in 2025, lending and leasing of vehicles will become more affordable,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.9% on 2024, inflation will be 4.5%.

The pessimistic forecast scenario assumes the following:

2024

- the macroeconomic situation in Russia will remain difficult. GDP in 2024 may grow by 2.8% on 2023, inflation will be 8.5%.

2025

- the key rate of the Central Bank of the Russian Federation will continue to grow in 2025, therefore, loan and leasing interest rates will increase,

- the macroeconomic situation in Russia will remain difficult. GDP in 2025 may grow by 1.4% on 2024, inflation will be 6.2%.

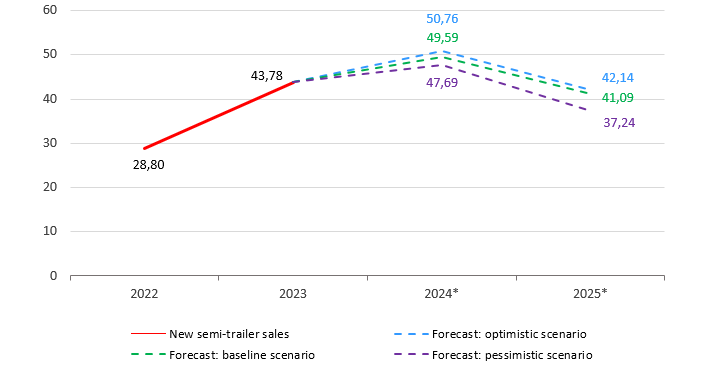

New semi-trailer sales forecast for 2024-2025

| Sales forecast, scenario | Semi-trailer sales forecast in 2024, thousand units | Growth/loss, 2024/2023, % | Semi-trailer sales forecast in 2025, thousand units | Growth/loss, 2025/2024, % |

| Optimistic scenario | 50.76 | 15.95 | 42.14 | -16.98 |

| Baseline scenario | 49.59 | 13.28 | 41.09 | -17.15 |

| Pessimistic scenario | 47.69 | 8.94 | 37.25 | -21.91 |

Source: NAPI (National Industrial Information Agency)

New semi-trailer market forecast till 2025, thousand units

* forecast

Source: NAPI (National Industrial Information Agency)