23.12.2025 / "We have faced a challenge": how 2025 affected the leasing market

Ivan Korovnikov, Director of Business Development, Alfa-Leasing Group of Companies

Ivan Korovnikov, Director of Business Development, Alfa-Leasing Group of Companies

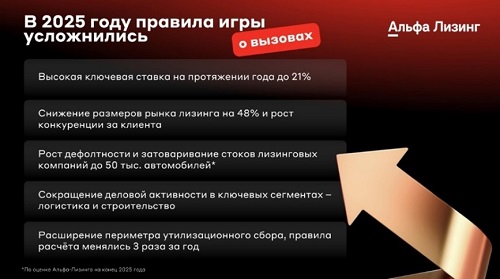

In 2025, the leasing market faced significant challenges: a high key rate, a decrease in customer purchasing power, and an increase in stocks. The marketing agency NAPI discussed how leasing companies have adapted to difficult conditions, which issues have been resolved, and which will remain priorities next year, with Ivan Korovnikov, Director of Business Development at Alfa-Leasing Group.

— In 2024-2025, a large number of vehicles were handed over ahead of schedule by lessees, or were withdrawn by the leasing companies themselves. As a result, significant stocks have accumulated. What is the current stock situation?

— 2025 was objectively the most difficult year for the industry, because, on the one hand, demand decreased significantly and competition in the market for this limited demand was quite high. On the other hand, all leasing companies had matured portfolios and, in this regard, their own stocks were growing.

We estimate the current market stock at 50 thousand vehicles. These are the stocks from leasing companies, which we can calculate based on offers in open sources: on the websites of leasing companies and classifieds. In fact, the volume of stocks is significantly higher, it's just that leasing companies approach the withdrawal and sale of vehicles in different ways: some companies immediately withdraw and put vehicles on sale, while other hold the withdrawal due to limited demand, the need for maintenance and storage, restructure clients, and search for assignees. As a result, we all don't see the full picture of the problem.

We estimate the current market stock at 50 thousand vehicles. These are the stocks from leasing companies, which we can calculate based on offers in open sources: on the websites of leasing companies and classifieds. In fact, the volume of stocks is significantly higher, it's just that leasing companies approach the withdrawal and sale of vehicles in different ways: some companies immediately withdraw and put vehicles on sale, while other hold the withdrawal due to limited demand, the need for maintenance and storage, restructure clients, and search for assignees. As a result, we all don't see the full picture of the problem.

But, in general, 50,000 stock vehicles are a significant challenge for the industry. We also have face it. The challenge, first of all, was that we started developing the competence to sell distressed assets from scratch. We have invested a lot of resources in digital stock, created jobs, opened large full-service hubs in Moscow and Saint Petersburg, and plan to open new outlets next year.

More recently, we have digitized the lease assignment, which is also one of the important tools in the fight against stocks. We help to find a new lessee by publishing offers on a new special online showcase or classifieds, as well as documenting the assignment of rights with a guarantee of due diligence. This solution allows customers to exit the current lease agreement faster, without returning the vehicle to the leasing company's stock and without the risk of worsening their credit rating.

Currently, every third vehicle that we lease is purchased from our own stock. At the same time, next year the task of working with stocks will be no less a priority and significant for all leasing companies.

— Is there any threat of a sharp increase in stocks in 2026?

— Probably not. The main growth took place at the beginning of this year. Now we have reached a plateau, that is, for the last three months we have been selling seized property 1.5 times more than we are withdrawing from lessees. At the same time, stocks are still large, and the three-month period has not improved the overall result sufficiently, with more being withdrawn than sold in the previous nine months.

— Keep talking about stocks, is it possible to say that leasing of new trucks, special purpose vehicles, and semi-trailers will not grow due to the fact that customers prefer fresh used vehicles from stock?

— Only partly. It is clear that the large number of offers of used vehicles affects the new business in one way or another, but the consumer behaves differently. For example, at the end of July, Rosstandart imposed a ban on the release of trucks by a number of brands. At the same time, we saw that the consumer switched over not to buying Alfa-Leasing stock, but to other brands. In August, we saw an increase in sales of new SHACMAN and KAMAZ vehicles.

Mostly seized vehicles, that is, with mileage, are acquired by small and micro-businesses, while new ones - by medium and large businesses in the construction and industrial segments. We can say that supply of fresh used vehicles will largely "plug the holes" in some individual positions, for example, in sanctioned brands and in micro-business, which has a much older and worn-out fleet.

Mostly seized vehicles, that is, with mileage, are acquired by small and micro-businesses, while new ones - by medium and large businesses in the construction and industrial segments. We can say that supply of fresh used vehicles will largely "plug the holes" in some individual positions, for example, in sanctioned brands and in micro-business, which has a much older and worn-out fleet.

— Let's switch to other leasing items. How profitable is equipment and real estate leasing now?

— In our retail business, we are mainly focused on motor vehicles and special purpose equipment. The share of equipment in our portfolio is about 3%, but we are looking at this niche and plan to develop in this segment. For example, we have an equipment product in the metalworking segment, in which we provide customers with a 10% advance payment. In our opinion, this allows clients to grow their business without diverting a significant part of their working capital, which is important in conditions of limited free liquidity.

— Speaking of preferential leasing programs, are they enough now to maintain the attractiveness of leasing offers, or does support need to be expanded?

— We actively participate in government support programs. All the programs that are provided at the federal and regional levels certainly help to support locally produced vehicles and make leasing more affordable. Two programs are in the greatest demand among our clients. The first program is "Wheeled Vehicles" offered by the Ministry of Industry and Trade. It is worth noting that the Ministry of Industry and Trade predicts volumes well, allocates a sufficient number of limits in order to support both Russian automakers and potential lessees. The second subsidy program is offered by the Republic of Belarus. Subsidies themselves are a good sales tool and a real value that customers see in a leasing company. A little over two thousand customers have used the subsidy this year.

— In January next year, VAT will increase from 20% to 22%. Do leasing companies see this as a problem, and how will it affect current contracts?

— It definitely won't go unnoticed. I would highlight several aspects. The first aspect is the refinement of accounting systems and business processes of the company, as well as attracting resources for automation. Secondly, VAT will have an impact on lessees, imposing an increased burden on them. Thirdly, reduction of the threshold for mandatory VAT payment will have a significant impact on companies in the SMB segment. We have clients who used on a simplified taxation system. The income limits at which they have to start paying VAT have now changed. Their VAT increase will affect them more, because it will increase the debt burden and require additional resources.

— What is the forecast for the leasing market for 2026?

— We expect the leasing market to grow at the pace of about 10-12%. The main factors that will have the greatest impact will be monetary policy and economics. According to forecasts of economists, next year the key rate will significantly fall. This should provoke pent-up demand, which will give a certain impetus to market growth. This year, our sales were growing by 5-7% monthly with each change in the key rate.

Leasing for individuals may become another potential driver for the industry. There is significant potential in this. However, this requires fiscal policy easing, and the chance that VAT on leasing for individuals will be abolished is still tending to zero.

Challenges remain partly the same as they were this year. The first is working with stocks. The second task for us is digitalization of processes within the company, as this helps to increase both the service component and productivity. That is why we are investing in digitalization and the development of artificial intelligence. The third one is non–interest income from additional services. We will continue to work with these tasks in 2026.

I would like to note one more thing: this year we initiated the creation of a leasing business club based on the Moscow School of Management Skolkovo. It was designed as a platform for graduates and trainees, entrepreneurs, representatives of the automotive business, and finance who want to understand leasing more deeply, discuss real business cases, and receive expert support. Therefore, we urge all the colleagues who are interested in developing in the field of leasing to join and take an active part in the discussions.

I would like to note one more thing: this year we initiated the creation of a leasing business club based on the Moscow School of Management Skolkovo. It was designed as a platform for graduates and trainees, entrepreneurs, representatives of the automotive business, and finance who want to understand leasing more deeply, discuss real business cases, and receive expert support. Therefore, we urge all the colleagues who are interested in developing in the field of leasing to join and take an active part in the discussions.

— Recently it has become known that Alfa-Bank acquired the Europlan leasing company. How will the work strategy of Europlan and Alfa-Leasing leasing companies in the market be built?

— The news is really fresh and many people are interested in it. I can say that this is a significant purchase for Alfa-Bank, which will help it grow its customer base, diversify its leasing portfolio and double its share in the current market. It is still very early to talk about any strategy for combining companies.

Alfa-Leasing will continue its work, focusing on the product line, digitalization of the service, and introduction of artificial intelligence and technologies. We will develop infrastructure and increase productivity.

Image source: Alfa-Leasing Group of Companies